Introduction

Delegates, here is the MERC May Newsletter, please circulate the Newsletter to your fellow Councillors and senior staff this week, so they can appreciate and understand the excellent work the Association and you are doing on behalf of your Council and community, with regard to mining and energy related matters.

Resources, Energy, Industry & Innovation Forum in Dubbo 6th – 9th June

MERC partnered with RDA Orana to run the Resources, Energy, Industry & Innovation Forum in Dubbo during the period 6-9th June 2023. This was a change from the earlier mooted dates of 23rd-26th May 2023, due to the clash with other events affecting the attendance of delegates and the unavailability of venues to accommodate the needs of our conference. This late advice of the need to change plus slowness of speaker confirmations caused a delay in the marketing of the event and member attendances.

All Councils, Councillors, Joint Organisations of Councils, General Managers throughout NSW were invited to attend individually, as well as stakeholders from industry and government agencies who were enticed with marketing material via social media and email etc., to ensure state wide coverage of this very important and often missunderstood topic with decision makers having to strive for –“ zero emissions” Federally by 2050 and less in some states.

On this basis, using the expertise of our event partners at RDA Orana and our input, a lot of questions were asked, answered and the impacts on our communities clarified and undertsood at the conference so Councils could adjust accordingly.

It is anticipated that potential members for MERC will emerge as they will see that MERC is a specific valued apolitical voice for any Councils in NSW with mining & energy related developments or be a member out on interest for Local Government communities generally in NSW. by way of MERC having the ability to organise this conference and being an advocate with a strong voice for them.

A full report on the event will be presented to members when completed. Already changes have been discussed at the Ordinary meeting on 9th June 2023.

Next Meetings of Association – The next Ordinary meeting will be in Sydney in August 2023 at NSW Parliament House during sitting times, if dates are suitable and there are rooms available, as renovations are underway. The AGM meeting will be held in November at a location/date to be confirmed. The Executive Committee will have a meeting in next few weeks (by teleconference) to determine the date and location of the MERC August meeting.

Next Years 2024 Forum (REIIF) The REIIF date slots have been temporarily booked for next year in the week 5-7th June 2024 only over 3 days. Subject to Executive Committee concurrence, the conference will be run in partnership with RDA Orana with MERC’s Ordinary meeting being held on first day 5th June 2023, followed by site visits, networking dinner day before conference day for councils and experts and having non members and potentially new members attend as observers, then business day on 7th June 2023. More later when de-brief report from RDA Orana is received.

COVID-19 Virus Impact on MERC – In 2023 MERC will be resuming its’ meeting cycle activities in the normal manner. What this means for MERC delegates is that 2023 will have quarterly meetings as “face to face” meetings with use of zoom in exceptional circumstances. Executive Committee meetings will be by zoom means as determined. A lot of value is gleaned from being at a meeting in person and this can be lost when delegates attend by zoom. The focus will always be on giving delegates an opportunity to attend meetings. However, delegates must be present to vote for the AGM in view of the voting system in the constitution.

Speakers for Next Meeting in Sydney – The invitees to be approached to speak at Sydney should be easier to attract them, given that Ministers, Shadow Opposition, etc., should be available if in Parliament House or York St rooms.

Inland NSW Growth Alliance (INGA) (formerly Orana Opportunity Network – O2N) – MERC is trialling as a Bronze Member of INGA for 12 months. Their Newsletters are available on their website on rdaorana.org.au.

CRC Transformation in Mining Economies (CRCTiME) Post Mining – MERC is a partner with CRC TiME on a no cost but consultative basis. They provide quarterly updates on progress with an opportunity for members to join webinars, workshops, surveys etc.

Life Membership & OAM Bestowed on Peter Shinton – At the MERC Ordinary meeting on 9th June 2023, the Chair of MERC, Cr Kevin Duffy, assisted by Leader NSW Nationals, Shadow Deputy Premier, MP Dubbo, Dugald Saunders pinned a life membership badge on Peter and presented a plague to him to recognise his service to the Association as a former Chair. Over the weekend Peter has also been recognised in the King’s Birthday Honours with an OAM for services to Local Government and his community. Well done to Peter.

Nuclear Energy Opportunities for Communities, Towards Zero Emissions – Robert Parker, Nuclear for Climate Change

In seeking to get information on the table so that delegates to MERC and to the recent conference understand what the taboo subject “nuclear energy” is about Robert Parker was engaged to present to the Resources, Energy, Industry & Innovation Forum 6-9th June 2023, in Dubbo in the session Opportunities for Communities talking about Energy in Society, Low-Cost Reliable Ultra Low Carbon Grid Power, Nuclear Power Plant Options and Applications and how to Participate in the Nuclear Fuel Cycle.

His presentation slides will be forwarded under separate cover to delegates.

The Future of Natural Gas in NSW & Implications for State & NSW Local Government- Andrew Grogan, EDG Partners

Once again to get details to MERC delegates on what “natural gas” energy really means away from the media and politicians, in the absence of Santos who could not make the conference, Andrew Grogan, as a consultant engineer in gas economics, was engaged to address the Resources, Energy, Industry & Innovation Forum on Opportunities for Communities.

His paper was on looking at what Councils can do and the implications for State and Local Government with natural gas in the Energy Transition Context, as follows:

- The world requires a phasing out of fossil fuels to prevent catastrophic warming.

- Recent major price increases for gas, coal and oil are hastening this process.

- NSW gas use will decline as part of a Net Zero Energy transition.

- Australia has land and sunshine, ideal for renewable PV generation, which can be cheaply stored in battery/PHES systems without the need for gas firming.

- EVs charged with this renewable electricity can help to reduce another major source of Australian emissions (road transport) – but regional charging points are needed [range anxiety]

Solutions he suggested.

- Local Governments have access to suitable land and facilities for both PV generation and for carbon removal projects (high quality forestry projects)

- High quality carbon offset (tree planting) projects can leverage off available land areas, and provide necessary carbon removals as part of Net Zero Emissions

Slides will be forwarded to delegates under separate cover.

Mining & Renewable Energy articles

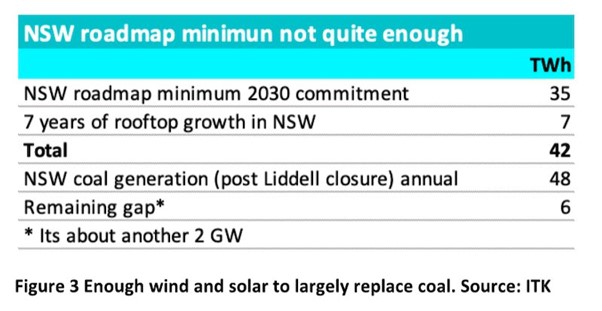

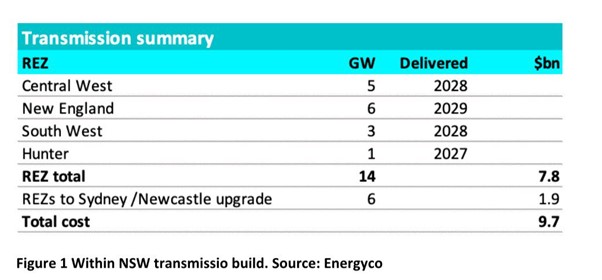

“Coal in NSW could be Squeezed Out by End of Decade but Timeframes are Tight” David Leitch, 2nd June 2023, RenewEconomy, writes “Firm plans have been developed for enough New South Wales transmission for 14GW of new wind and solar, but most of that transmission won’t be complete before 2028.

If all 14GW is built and adding in rooftop growth and pessimistically assuming no demand growth, then all the coal generation in NSW will be squeezed out/replaced by 2030, or 2032 at the latest. The transmission will cost around $10 billion once downstream links to load are also built. That will essentially double the value of transmission installed in total in NSW.

The process will introduce more competition into transmission ownership and operation within NSW. Although clearly slow, the process seems thorough and should/could give more confidence to wind and solar developers. The planning process for approving wind farms has been streamlined but developers still have to go through eight steps, even in a best case scenario, and can expect to spend two years or more on biodiversity and similar studies.

Around 6GW of wind have progressed to the latter parts of the EIS approval process but some of those projects will still face significant community resistance (eg. the big hat Barnabites and Barnaby wannabes who oppose Winterbourne). The market will be tight between now and 2028 although increased transmission from Victoria and Queensland will help.

NSW Energy Minister Hon Penny Sharpe seems to be trying to throw the social license message off course and needs to get on message and lead the social license proposition from the top. I doubt that Origin has any intention of selling Eraring back to the state and the sooner we move on from that scare campaign the sooner progress will be made.

In the meantime, the behind-the-meter industry is standing by in case either the state or federal government work out that they have an unexploited reliability asset ready to deploy in the form of household batteries.

Recently EnergyCo released its “NSW Network Infrastructure Strategy” [NIS]. This document outlines EnergyCo’s latest and most comprehensive views on what transmission needs to built within NSW, the timing and the cost. The latest episode of the Energy Insiders podcast discusses the strategy with James Hay, CEO of EnergyCo and Andrew Kingsmill, executive director (technical).

The NSW electricity decarbonisation program is not actually called that, but it amounts to replacing all the privately owned coal stations with privately owned variable renewable energy and supporting firming power. The carbon reduction was not mentioned once in the NIS report and nor does it appear to be an explicit constraint in the modelling process. No matter, the economics of wind and solar are sufficiently strong despite capital cost increases as to make them the natural choice.

The coal stations will end up being replaced because they won’t be able to compete with lower variable cost wind and solar once it’s built, and because they are, in any event, old, at risk of breaking down, or don’t have reliable access to coal; or have full ash dams and other issues.

The prerequisites for the transition include that enough new wind, solar and firming is built, have satisfied AEMO’s generator performance standards [GPS] or derogated NSW equivalents, and have transmission they can connect to. It turns out that building wind farms has become a highly skilled, value-added business.

Wind farm sites with potential for connection are hot property in every state; those that have done most of the four to seven years of wind speed measurement, connection planning, environmental planning and social license approvals required, even more so.

Yet, in the end, the thousands and perhaps tens of thousands of construction jobs, and the regional management of the resulting generation and infrastructure is, in my opinion, the biggest decentralisation opportunity that NSW (and Queensland) have had in many years.

Little towns like Uralla are booming because of one solar farm (450 construction jobs). When the next drought hits the diversified income will be invaluable. Yet none of it can happen without transmission.

A summary of the NIS is that $10 billion will be spent by FY29 to enable 14GW of new generation to be connected:

The plan also allows for significant further expansion beyond 2029 as that becomes necessary. The $10 billion spend is almost identical to the average real size of the existing Transgrid regulated asset base [RAB]. And so, it’s reasonable to assume that the cost to consumers, spread over the entire NSW consumption, not just the REZ production, will be about the same as what Transgrid currently charges. And that is $14/MWh in real terms.

In short, this program will double NSW transmission costs, but on the other hand consumers will avoid paying coal costs and existing coal plant maintenance costs. The overall impact on electricity prices of the NIS has yet to be officially commented on. The basic point is that the coal stations had to be replaced.

The claimed main benefit of the NIS is the certainty it provides to developers that they will be able to connect. The biggest problem, in my mind, is how long it’s going to take. The NSW Road map was announced in 2020, transmission to make it a reality will be on board in 2028.

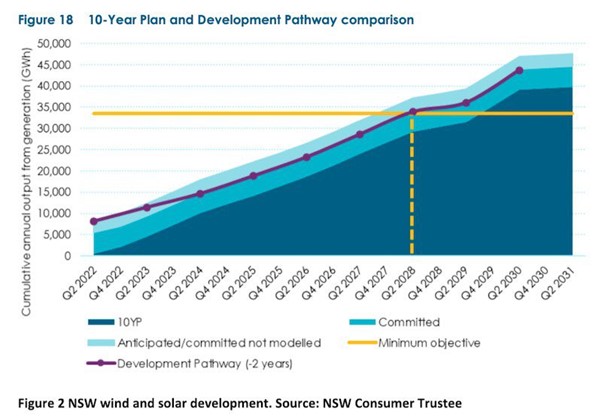

The development plan that EnergyCo’s sister organisation, the NSW Consumer Trustee, has published (but which hasn’t been updated for a while) calls for 35TWh of developed wind and solar by Q2 2028.

Looking at the below graph one imagines renewable energy coming online every year at a steady pace. Indeed LTESA (insurance) contracts will be issued at a rate of about 2GW per year to aspiring developers. But even assuming they had built the plant, there will be little or nothing to connect to prior to 2027. So, there will be a fairly big connection process going on from 2027 to 2029. In numbers, about 9GW will want to be connected over a couple of years.

Skills are a challenge. Essentially all the transmission is expected to be operational in 2027-2029. In other words, it’s all going to be built at pretty much the same time as the wind and solar is being built. And that’s just in NSW. Queensland will be going through a similar build, maybe a year or two behind.

Clearly there is room in NSW for some expanded training like the recently announced Queensland “Super grid” training centre to be established in Gladstone, to upskill 500 workers per year. Lots of higher-level skills will also be needed. These are not the responsibility of EnergyCo or the NSW Trustee but rather the state government.

Of course, these numbers above don’t account for changes in either net imports or changes in demand. Right now, importing more energy from Victoria would help Victorian producers and NSW consumers. But once Yallourn closes there will be some tightness in Victoria for a couple of years.

Of course, these numbers above don’t account for changes in either net imports or changes in demand. Right now, importing more energy from Victoria would help Victorian producers and NSW consumers. But once Yallourn closes there will be some tightness in Victoria for a couple of years.

It’s one thing to talk about social license and another thing to earn it. This is another reason why minister Sharpe’s panic talk about Eraring is absolutely making things more difficult for everyone in the NSW energy system.

Social license – at a minimum, acceptance, and at best, trust – must be built at every level. Social license must be achieved for a wind or solar farm, for the REZ it operates in, for the new transmission and, at the most top level, the overall confidence of voters and consumers in the “efficacy” of the electricity system. Of course, this requires credible, consistent, and unified messaging, led by the minister and extending down to the most junior apparatchik.

It was interesting, therefore, to hear of how planning and social license are being progressed through the NSW road map.

According to James Hay and in line with my above comments, the primary focus is about building a long-term big picture message. Communities in a REZ will be able to appreciate the totality of what is being proposed.

Beyond that, EnergyCo has funded a dedicated team within the Department of Planning. The idea of this team is to be specialists in wind and solar projects. Basically, I can see how this will improve the process due to the familiarity of the specialists. As a result, planning fees for applicants have been reduced.

Further, and perhaps more minor, there is a standardised approach to what’s in it for councils and the council can expect a relative standard contribution from a project within a REZ. That, too, should reduce the overall time taken. This is probably as much as can be done without substantially changing the existing planning process.

An example of the planning process and a good description was provided by Neoen, in respect of the Thunderbolt Energy Hub.

In the best-case scenario – i.e. no Land and Environment Court cases – there are eight formal steps for a State Significant Development approval, see below:.

- Neoen submits Scoping Report to NSW DPIE.

- SEARS – DPIE provides Secretary’s Environmental Assessment Requirements.

- EIS Preparation where Specialist studies are undertaken, EIS Report is prepared

- EIS Submission NEON submits the EIS Report to DPIE;

- Public Exhibition of EIS Report & Submissions made by community and stakeholders.

- Response to Submissions by Neoen;

- Assessment by DPIE of DA and Submissions;

- Determination by Minister Planning or IPC make the final decision.

In the case of Thunderbolt, Neoen submitted the scoping report in November 2020 and received SEAR’s requirements in December 2020. Following this, specialist studies for EIS were undertaken which include two years of ecology studies.

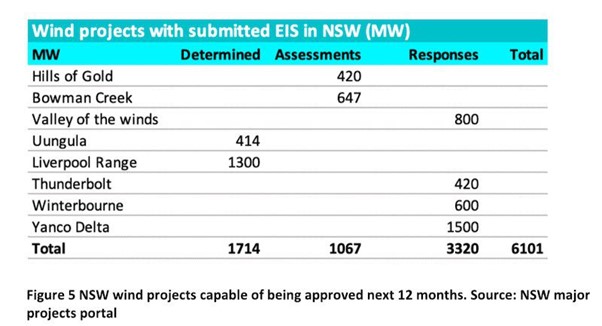

Why mention all this? It’s mainly to note it takes time to develop wind farms. The list of wind farms in NSW that have reached at least stage six of the above process but haven’t yet started construction is:

Of those, the Liverpool Range site has been approved since 2018 for 1000MW. But Tilt, which acquired it in 2019, is now proposing 1300MW. Certainly, none of these projects are speed demons in terms of getting started.

Even once notice to proceed is issued its likely that three years of construction will be required. Developers could, and arguably should, speed this up given their confidence by, for instance, doing early road works. Typically, 20-50 km of roads have to be built.

My point is that it will take a while for any of this wind to help NSW consumers; at least three years for these projects and ignoring a couple under construction, principally Rye Park. On the above list only Uungula has any chance of getting Notice to Proceed this calendar year.

I have, however, heard several concerns expressed in advance of the “batch” process experience, more properly called the REZ connection process. Andrew Kingsmill made two, to me, important points about this in the Energy Insiders podcast.

Firstly, that generators within a REZ will have clear REZ determined generator performance standards to meet and secondly, and perhaps more importantly, that NSW can “derogate” – that is, to an extent, step outside the NEM rules and make its own connection rules.

EnergyCo is in the process of formulating such a rule. I guess ultimately AEMO will still have a say and EnergyCo will still need to demonstrate that its rules result in an improvement, compared to the current process, and must mesh with other streamlining proposals. Nevertheless, this explanation was a cause for optimism.

It remains a mystery as to why federal and state policy turns such a blind eye to behind-the-meter storage. There are “nation building” pumped hydro projects such as Snowy 2.0, Borumba or any of the pumped hydro projects that have been mooted in South Australia for a decade and in NSW for five years.

These can all get support without trying too hard. If the state government money is not enough, don’t worry the federal government will back it up with the Capacity Investment Scheme.

To a far, far lesser extent the same thing goes for utility batteries. These have access to system services revenue and again can be eligible for either state or federal capacity support. But even with that support it takes a couple of years for each of these batteries to do their connection agreement, organise the finances, run with the lead times and get built.

I, of course, think utility batteries are terrific and the longer-term solution to the majority of the NEM’s storage needs (other than seasonal and VRE droughts). Yet household batteries can be done faster, and consumers will pay most of the cost.

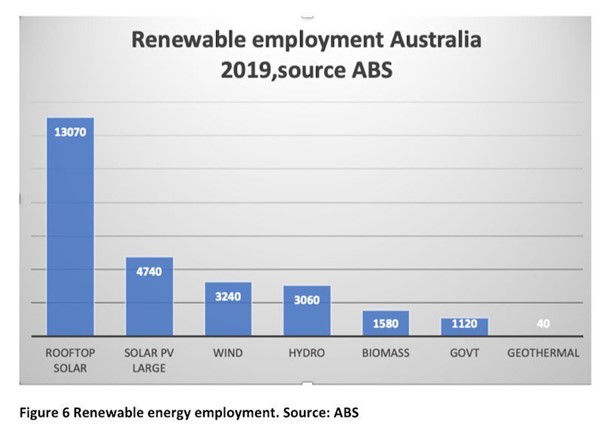

I don’t believe the renewable energy employment statistics have been updated since 2019, but at that time the rooftop industry was easily the largest employer and I suspect it remains so.

The rooftop industry is, by and large, fully trained, doesn’t suffer a skills shortage and can easily, easily sell more household batteries. As I have previously written, the batteries and the associated inverter software are far more capable than they were five years ago.

There are plenty of competing brands and the sector continues to innovate. Tesla, the market leader by far is about to launch the Powerwall 3 which has 11.5 kw of maximum power, far more than most houses need at one time.

In NSW, 100,000 of those Powerwall 3s running at once could deliver more than 1GW of firming power into NSW and it could be done, arguably, within 12 months, or certainly two years – i.e. by the time Eraring closes

If you are one of the increasing number of people, not currently including me, who think that vehicle-to-grid is a better idea than household or community batteries, then incentivise that sector. But I don’t think the standards and technical side of vehicle-to-grid are settled yet and in any event the EV industry has already shown there won’t be sufficient supply to make a difference in NSW in the next couple of years.

I won’t say any more on the topic as it does seem to be controversial (subsidies for the wealthy, community batteries are cheaper, household batteries are too expensive, vehicle to the grid will render household storage obsolescent) – but I just continue to find the idea attractive and capable of providing a quick improvement to the NSW reliability outlook over the next three years.

My electricity bill with seven people in the house, a heat pump on the pool, ducted air con and an EV is just $20 a month. And yes, I am lucky, but the NSW government could help to make more people lucky if it wanted to and take some of the strain off peak prices thereby improving the lot of all consumers”.

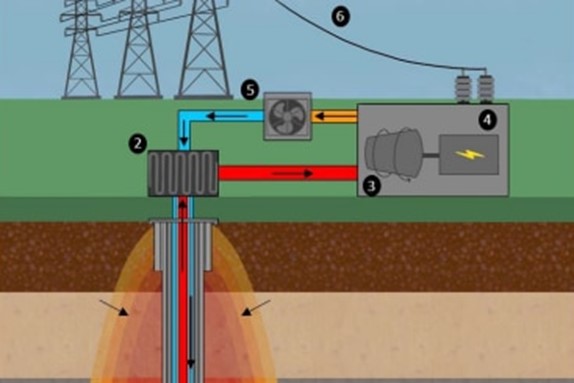

“Greenvale Energy thinks outback Queensland could be centre of geothermal power hub” ABC Western Qld, Victoria Pengilly, 12th June 2023, writes “John “Tractor” Ferguson’s town of Thargomindah experiences regular blackouts. John “Tractor” Ferguson remembers feeling excited when his outback town became the centre of a multi-million-dollar geothermal project. Thargomindah, about 1,000 kilometres west of Brisbane, is at the end of the line on the electricity grid and residents were experiencing frequent blackouts.

The council project, which received $3.6 million in state government funding in 2017, was designed to give locals cheap electricity. “We get what they call dirty power — power dropping down where your lights will go down and they’ll come up again,” Mr Ferguson said at the time. But six years on, the project, like countless others dotted around outback Queensland in Quilpie, Ilfracombe, Birdsville, Normanton, and Winton, has fallen over.

It has left locals like Mr Ferguson feeling like they “dodged a bullet”. Geothermal power was once hailed as the unsung hero of renewable technology with the potential to transform the sector, but over the past decade the hot rock industry has gone cold. So why does one mining company believe its project will be any different?

Last month, Greenvale Energy and CeraPhi Energy announced they would be conducting a feasibility study for a geothermal project in Longreach in central-west Queensland. The geothermal power plant in Winton was intended to power council buildings. The study will be conducted over 12 weeks and will assess whether the region’s naturally hot underground wells have the right conditions to sustain a power plant. If successful, the project would be the only working geothermal plant in Australia.

Greenvale Energy hoped the plant could be operational by 2026. “We’re confident we have the right technology and, once we get our plant up and running, there will be a lot of others that follow suit,” Greenvale Energy CEO Mark Turner said.

The project will use advanced geothermal systems, meaning the technology will not access underground water supplies, like traditional geothermal projects, but instead harness the power of hot rocks. “This means there will be no losses, it’s going to be a complete closed loop system,” Mr Turner said. Greenvale Energy says the power generated will support the township of Longreach.

Mr Turner said power generated by the plant would supply the township of Longreach, and excess power would be pushed to the national grid. He said the industry had learnt lessons from other mothballed projects in the region.

Last year, the Winton Shire Council launched legal action against the commercial arm of the Local Government Association of Queensland (LGAQ), Peak Services, over the failure of a $4 million geothermal plant. The plant was designed to use 86 degree Celsius hot water from the Great Artesian Basin to generate electricity to power council buildings. After three years of development and construction, the plant has never delivered power due to technical issues.

“The issues being faced at Winton are not really down to the geothermal technology but rather other factors,” Mr Turner said. “Geothermal power works and it’s been proven to work all around the world.” The Winton example is not the only project that has been marred with issues.

Peak Services previously described Australia’s first grid-connected geothermal power plant as “a potential game changer”.(Supplied: Winton Shire Council) In 2016, energy company Geodynamics closed and remediated the sites of several test wells and generation plants in the Cooper Basin in remote South Australia, after deciding they were not financially viable.

Similarly in 2018, Ergon Energy “reluctantly decided” to abandon a small geothermal station in Birdsville in favour of distributed solar and storage. Mr Turner said he was not deterred by geothermal’s checkered history. “I think we’re at the very beginning of what geothermal is going to look like in Australia,” he said.

The potential for geothermal energy appears to be staggering. Government agency Geoscience Australia once estimated 1 per cent of the country’s geothermal energy could produce 26,000 years of clean electricity. The technology is being used successfully overseas in countries like Iceland, New Zealand, and Indonesia.

But in recent years, state and federal governments have favoured solar and wind over geothermal in the rush to invest in renewable energy. Energy experts say geothermal power is having a revival. (Supplied: Geodynamics)

Director of the Australian Geothermal Association Graeme Beardsmore said the potential for geothermal was still strong. “If you look down at the ground beneath your feet, you wouldn’t realise there are huge amounts of energy underground,” Dr Beardsmore said. “It’s such a small industry globally compared to other industries. It’s very hard to visualise and understand.” He said failed projects had tarnished the reputation of the industry, but there was renewed interest.

Earlier this year, the WA government announced 21 geothermal exploration areas had been identified and were open for bidding. “We’re really at the start of a new wave of interest in geothermal. Watch this space,” Dr Beardsmore said.

Disclaimer The comments and details in the articles in this newsletter do not reflect the views, policies or position of the Association or its member Councils and are sourced and reproduced from public media outlets by the Executive Officer to provide information for members that they may not already be exposed to in their Local Government areas

Contacts Clr Kevin Duffy (Chair) cr.duffy@orange.nsw.gov.au or 0418652499 or Greg Lamont (Executive Officer) 0407937636, info@miningrelatedcouncils.asn.au. .

You must be logged in to post a comment.