Introduction

Delegates, here is the May MERC Newsletter, please circulate the Newsletter to your fellow Councillors and senior staff this week, so they can appreciate and understand the excellent work the Association and you are doing on behalf of your Council and community, with regard to mining and energy related matters.

New format for Newsletter

A suggestion by Cr Scott Ferguson, Blayney Shire Council Mayor and member of the Executive Committee of MERC that the newsletter have an Executive Summary at the front so busy delegates and staff of member Councils can have a quick read of the issues within the newsletter on matters of interest to them. Thereafter they can delve further into the details.

As we realise everyone is time poor so here goes with a different format for you. There will be an Executive Summary with governance items and then summaries of other items with more details are located further in. This should still give delegates the information they need albeit in a more condensed way. Hope you enjoy and any feedback would be appreciated.

EXECUTIVE SUMMARY

(a) GOVERNANCE MATTERS

- Next Meetings of Association – Next Ordinary meeting to be held in Sydney 2nd September 2022 at Club York, Second Level, 99 York Sydney. Executive Committee meetings will be called by Chair beforehand. After that a 2 day mini conference, AGM and Ordinary meeting to be held in Dubbo, arrangements and dates to be sorted.

- COVID-19 Virus Impact on MERC – In 2022 MERC will be resuming its’ activities in the normal manner. What this means for MERC delegates is that 2022 will have quarterly face to face meetings with use of zoom in exceptional circumstances and the Executive Committee meetings will be by zoom means until changed.

- Speakers for Next Meeting in Sydney – Minister for Planning, Minister for Energy, Minister for Regional NSW and Deputy Premier will be pursued plus Chair and CEO NSW Minerals Council and other speakers of interest for next meetings.

- Orana Opportunity Network (O2N) – MERC is trialing as a Bronze Member of ON2 for 12 months. Their Newsletters are available on their website on o2n@o2n.org.au.

- CRC Transformation in Mining Economies (CRCTiME) – MERC is a partner with CRC TiME on a no cost but consultative basis. They provide updates on progress with opportunity for members to join webinars, workshops, surveys etc. Latest update is below.

- Executive Committee Review– Review has been undertaken by Executive Committee and recommendations discussed at meeting on 3rd June 2022. Refer minutes for full details and a summary of them in this Newsletter below.

- Renewable Energy Zones (REZ) – Mike Young, Executive Director – Planning & Communities, Energy Corporation, Department Energy & Climate Change provided delegates with an informative insight on what is happening with Renewable Energy Zones in NSW. There is an opportunity for MERC to be part of a working party with Energy Co to successfully roll out the REZ’s. Refer minutes for full details and a summary of them in this Newsletter below

(b) OTHER MATTERS OF INTEREST IN DETAIL

(i) Executive Committee Review

The following are areas where MERC will pursue to improve its relevance as an entity and hopefully result in more memberships.

1. There is an acceptance of:

- non-elected delegates as members of the Executive Committee but not as the Chair at this stage;

- only one delegate from each member can be elected to the Executive Committee (already in place);

- the attendance at all MERC meetings of GM and/or other Senior staff from all members to accompany elected delegates at every MERC meeting to get more involvement of senior staff in MERC issues – to be encouraged by delegates;

2. Value Proposition would be improved if the following changes were introduced by MERC to its Strategic Plan:

- Establish a Register of Past Issues, how they were dealt with by MERC and the contact person – eg. VPA Guidelines Framework, Issues with Resources of Regions Criteria and Coal Seam Gas Policy development, etc.;

- Establish MERC as a Centre of Excellence for providing expert industry knowledge and information;

- Hold three (3) meetings in Sydney pa to coincide with the CMA meetings and a regional meeting either as a mini conference usually encompassing the AGM or AGM and Ordinary meeting;

- If a mini conference is held could be an annual or bi-annual event in the regions on all renewable energy issues – solar, wind, batteries, electric vehicles, hydrogen, critical minerals, etc.;

- MERC Executive Officer continue to receive minutes for all REZ Reference Group meetings and distribute to delegates;

- MERC to lobby more like it did with VPA’s and Resources for Regions on the Renewable Energy Zone impacts on Councils, their communities on issues such as housing workers during construction, impacts on agriculture, rehabilitation of solar and wind farms, waste management of assets used, infrastructure, Community Enhancement Funds, etc.;

- MERC to establish working parties through approaches to Minister for Energy, Minister for Agriculture, Minister for Planning on so forth or their Executive Directors building on current and new relationships through conducting meetings in Sydney with them in view of the challenges emerging with renewable energy and agriculture.

(ii) CRC for Transformations in Mining Economies (CRC TiME)

The following is the latest update on CRC TiME activities by Guy Boggs, CEO.

2022 CRC TiME Forum

Dates are locked in for 23 – 24 November 2022 for our second annual partners Forum. We are planning a full face-to-face event this year at ANZAC House in Perth, WA and are look forward to you joining us for some long overdue networking, sharing in latest research findings and to participate in practical workshops. Each year our forum will bring us together as a working event to share knowledge, check in on our progress and set the path forward for the year ahead as we work to implement our ambitious decade of transformation.

Forum Advisory Committee EOI

Following feedback from last year’s Forum, we are establishing a Forum Advisory committee made up of a small, representative group of partners. They will meet three times over the next six months and will have a key role in guiding the programming for the Forum. If you would like to nominate for the Forum Advisory Committee, please email me at guy.boggs@crctime.com.au before Friday 3 June, 2022.

New Initiatives and Project Co-Design

Thank you to the many partners who completed our initiatives interest survey and have since participated in our research initiatives workshops and consultation processes over the last two months. We have now released prospectuses for 7 initiatives on our Initiatives Summary Page. This reflects the initiatives that have or are soon to start their consultation and engagement process and we will be adding indicative project submission dates to help with partner planning.

We are committed to co-design of projects and appreciate the valued input from our partners into this process. We will be working to provide more coordination of this engagement. Completing the initiatives interest survey provides valuable input to support this. If there are initiatives that have been progressed, that you are considering getting involved with, it is not too late. Please contact tom.measham@crctime.com.au.

We are also working to produce a consultation roadmap/GANTT chart for projects we believe will progress for consideration at the October Board Meeting. These will be provided over the coming month, while noting opportunities for new projects are still being considered.

College Engagement

We thank our partners for their contribution to end user college-based workshops. Mining, METS, Regions and Communities and Government meetings have been held. These have been very useful in identifying shared challenges and opportunities within our key participant segments. This is helpful in informing both our process evolution and focus areas for initiative/project development. We will continue to schedule these.

First Nations Advisory Team and Engagement Officer

Thank you to those partners who nominated for the First Nations Advisory Team. Jim Walker has been an active Interim Chair, bringing significant experience and networks. We are currently finalising appointments and look forward to announcing the participants shortly. The FNAT will provide important input and oversight of First Nations inclusion activity across the CRC TiME portfolio. https://crctime.com.au/about/first-nations-advisory-team/

We will also begin advertising for a First Nations Engagement Officer soon. There are opportunities for this person to be based in Brisbane or Perth.

German Mine Closure Tour Opportunity

The two biggest German lignite producers, RWE and LEAG, are working on closure plans for their existing mines following a new German Government closure target of 2030. At the same time, old mines in Germany have been closed successfully, and rehabilitation works are ongoing. In some cases, final voids have been filled with water creating vast lake landscapes, enhancing the quality of life for the local community and tourists.

The German-Australian Chamber of Industry & Commerce, with support from Germany Trade & Invest, had been planning a 6 day delegation trip to Germany for May this year to experience first-hand what German mining companies and the METS sector have worked on over the last decades.

This is being re-scheduled and they have requested we ask our partners to express interest for a trip later this year. Please let Pat.tang@crctime.com.au know if you would be interested in the planning for a new trip.

Dig Deeper Webinars

We have had excellent numbers attending our first three Dig Deeper webinars. Open to the general public as well as partners, this webinar series showcases our research findings from the Foundation Projects and provides an opportunity to elaborate on your involvement in the project or learn about other related CRC TiME projects in a brief format. All webinars are recorded and are available to listen back to on the CRC TiME youtube channel and on our Dig Deeper webinar page. The fourth in the series is on next Friday 3 June and is looking at closure planning issues and opportunities as well as a network of demonstration and testing sites. Click here to register.

Impact Framework and Adoption, Monitoring and Evaluation

The CRC TiME Impact Framework was launched in March: https://crctime.com.au/macwp/wp-content/uploads/2022/03/FINAL_CRC-TiME_Impact-Framework_23.03.22.pdf

This is a critical document in framing how we connect research with impact and will be important in our initiative planning process as we design projects that invest not only in research, but in the adoption and translation activities and outputs that will ensure we create fit for purpose, innovative solutions.

We are currently scoping the Monitoring and Evaluation Framework that will support the tracking of progress against key impact objectives. There is an expectation that all projects will contribute reporting that aligns with and contributes to this M&E Framework.

Publications Update

Congratulations to all project teams on their work delivering Foundation Projects. A total of 22 publications across 18 projects have been received, with 6 in review and 16 published on our publications page and shown in the table below.

(iii) Renewable Energy Zones (REZ’s)

A REZ is a hub of renewable projects across a region that forma a modern-day power station, producing a large amount of energy for the State. The State Government has set them up in the New England, Southern NSW and Hunter/Central Coast Regions. The latest updates from Energy Corporation NSW & NSW Consumer Trustee, by James Hayes, CEO EnergyCo:

Mike Young in his presentation to delegates 3rd June outlined the following:

- Energy Corporation of NSW is a statutory authority re-established in line with legislative functions under the Energy and Utilities Administration Act 1987 and Electricity Infrastructure Investment Act 2020 has been set up to “join the dots” with the design, delivery and coordination of Renewable Energy Zones (REZ’s) and other electricity infrastructure in a way that benefits consumers, investors and regional communities;

- Transmission development is becoming increasingly controversial in local communities, with communities already raising concerns with compensation, consultation, land use conflict and cost recovery.

- The loss of social licence has the potential to delay the rollout of transmission infrastructure which would jeopardise energy security, slow NSW’s transition to net zero emissions and increase electricity costs fro consumers. To avoid this the government will need to actively build community support for the transition rollout.

- Consequently, Mike is keen to work with MERC to establish a dedicated forum, with strategic planning & coordination, developing a governance model for community benefit funding for community projects.

- Given MERC’s involvement with VPA’s and Resources for Regions criteria working parties involving Department of Planning and stakeholder bodies like the NSW Minerals Council in the past he has suggested to delegates that MERC could work with Energy Co with some of the foregoing. If it comes off there may be funds available for this that MERC could be eligible for its involvement.

(Slides have been distributed)

The REZ’s are receiving a huge interest from renewable energy businesses providing a challenge for the NSW Government to facilitate it and for local communities/Councils to grapple with. Current MERC process for involvement in the REZ’s is by receiving minutes/newsletters from each REZ Regional Reference Group meeting and forwarding them to members. MERC does not have members in every REZ that is being established.

If MERC is to get more involved in the REZ’s it would need to have a discussion at a future meeting to review the current Strategic Plan actions and how it would like to resource any actions if it were to become more involved in the processes across the whole of the State given the growth of the REZ throughout NSW. Waiting on Mike to outline how this would work.

(iv) Related Matters of Interest – Coal Mining, Renewable Energy & Microgrid Issues

“Australia’s Biggest Coal Plant Cant Get Enough Coal, as Fossil Fuel Disaster Accelerates” Giles Parkinson, Renew Economy, 1st June 2022 writes:

The fossil fuel crisis affecting Australia’s energy markets took a new twist on Wednesday when Origin Energy, the owner of the country’s biggest coal generator, confirmed it could not source enough coal to keep the 2.8GW Eraring plant in NSW operating at anywhere near full capacity.

The supply problems add to the soaring coal and gas prices, and coal plant outages, that have driven the electricity markets, and analysts, crazy in the past few weeks, resulting in the collapse of some energy retailers, “house full” signs on others, and skyrocketing bills for consumers.

See: “Sorry, we can’t help today:” Energy retailers turn away customers in face of crazy prices

In its quarterly update, Origin confirms its view that the price rises were being driven by coal plant outages and high fossil fuel prices and warns it will continue in at least the near term until more renewables can be brought into the grid. “The challenges with coal delivery to Eraring Power Station are expected to persist into FY2023,” it says in its quarterly update. This is expected to result in a material increase in coal purchasing costs given high coal prices and continued exposure to high spot electricity prices.

“While Origin has worked closely with coal suppliers to secure additional coal supply by rail, there are limitations to the amount of coal that can be delivered to the plant by this method. Therefore, there is uncertainty regarding the plant’s output in FY2023.”

The news will be of huge concern to energy market authorities, who fear that other coal fired power stations will be similarly challenged, apart from possibly the brown coal generators in Victoria that can dig up the dirt in their backyard.

The future of those plants is now under question, although it is clear that tech billionaire Mike Cannon-Brookes, who has scored a stunning victory in seeking to change the coal-burning strategy of AGL, knows that new renewables and storage are an absolute priority before any more closures.

But the situation also underlines the fragility of a power system that has been so dependent on dirty fuels, unreliable and ageing plants, and now crippling coal costs and supply shortages.

See: Australia’s electricity markets are on crack: It’s time to do something

The issue with Origin seems to be specific to the supply problems with the Mandalong mine, compounded by limited rail access and supply chain issues. But it just adds to the vulnerability of relying of ageing fossil fuel technologies in a dramatically changing environmental and financial environment.

Queensland coal fired power stations have also suffered from floods, which has caused supply issues because coal can no longer be delivered by rail and have to be done by truck. It adds to the unfolding disaster left by the Coalition government and the previous energy minister Angus Taylor, who had no interest in smoothing the transition to green energy and instead erected policy bollards and committed billions to fossil fuel industries.

Australian industry and consumers will be paying the cost of this disaster for years. The energy market is now considered to be out of control, with all the usual financial hedges proving useless in a market where the cost of so called “baseload” is now more than that of generating power from diesel.

Energy analysts have been warning of this looming disaster for years, although they could not have predicted how quickly it would be accelerated by events overseas, including the Covid19 pandemic and Russia’s invasion of Ukraine. Origin says market volatility will continue, while its own earnings will be balanced out by a windfall from the sales of gas and LNG at extraordinarily high prices, offset by the increased cost of coal generation. It says Eraring has been facing supply challenges throughout the current financial year, and it has deteriorated in recent weeks, with one of its main suppliers, Centennial Coal, warning of “further constraints associated with geological features at its Mandalong mine.”

The delivery shortfall amounts to around one million tonnes this financial year, but interruptions will continue for the rest of this calendar year, a situation made worse by delays in equipment supply, which is stopping Centennial from immediately addressing the problems in the mine. It has forced Origin to go into the market for new coal supplies, at a time when it is difficult to source and where the costs for what can be sourced are substantial.

“The recent material under-delivery of coal to Eraring results in lower output from the plant, additional replacement coal purchases at significantly higher prices, and is being exacerbated by coal delivery constraints via rail,” Origin says. “In addition, the lower output from Eraring results in a greater exposure to the purchase of electricity at current high spot prices in order to meet customer demand.”

As a result, Origin now expects its underlying earnings from the energy markets division this financial year to range from $310 million to $460 million, lower than the original guidance range of $450 – $600 million. The supply problems for Eraring, the high cost of coal and the exposure to high spot electricity prices, will continue into the next financial year and despite an expected windfall from its gas operations it has dropped all profit guidance for the coming year.

“Origin will continue to assess the outlook, with a view to providing an update at (our) full year results in August,” it says.

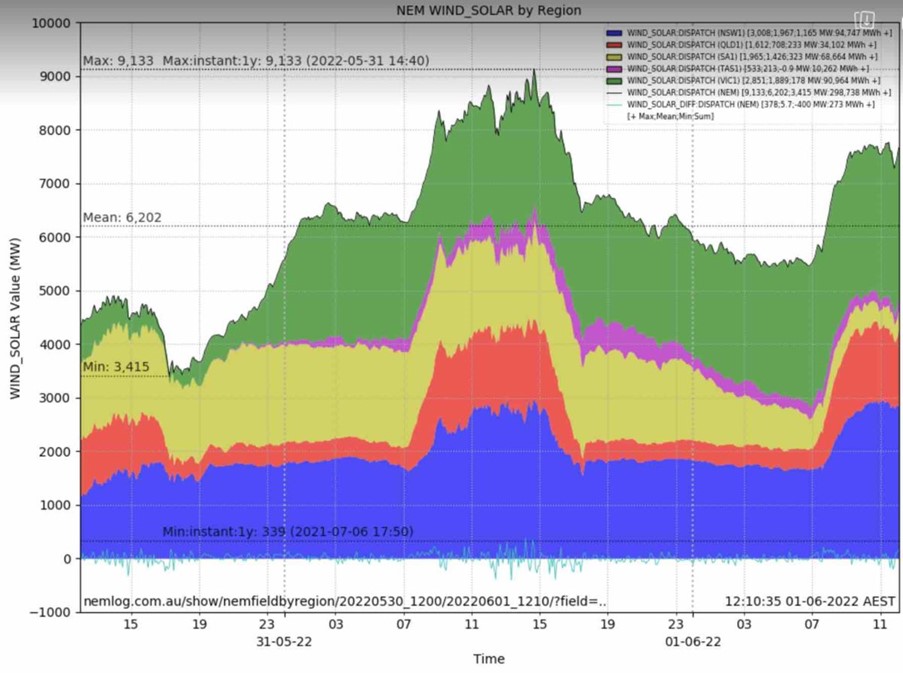

“Wind and Solar Set New Combined Output Record in Australia’s Main Grid” Giles Parkinson, Renew Economy, 1st June 2022 writes in relation to the following chart:

The combined output of wind and large-scale solar farms set a new record on Tuesday afternoon, as wind alone also posted a new record high for the second day in a row.

According to Geoff Eldridge, from NEMLog, the combined output of wind and solar reached a new peak of 9,133MW at 2.40pm on Tuesday, May 31, beating the previous peak of 8,560MW set in the morning of March 31 this year.

A little later on the same afternoon, wind output alone hit a record high of 6,852.5MW at 4.45pm (AEST), little more than 12 hours after setting a new peak of 6,639MW earlier on Tuesday morning (2.30am).

The new records coincide with a strong weather front that has swept across southern Australia, bringing strong winds, cold weather and – in some areas – clear skies. Again, it had only a temporary impact on the soaring wholesale electricity prices that have swept the nation, causing grief for small retailers, customers, and even big players like Origin Energy.

The biggest beneficiary was South Australia, where wind and solar pushed prices into negative territory for most of the day as renewables provided more than 100 per cent of local demand.

However, prices quickly bounced back to above $300/MWh in South Australia when the gas generators seized control of the market again as the sun set and solar output waned.

Victoria (during the night), and NSW and Queensland (during the day thanks largely to solar), enjoyed brief respites from the soaring prices, which have averaged more than $300/MWh thanks to the soaring cost of coal and gas, supply issues which have crippled coal plants like Eraring, and coal plant failures.

Across the NEM, the combination of wind, solar and hydro stayed above 50 per cent of generation for much of the afternoon, but the market operator expects to reach peaks of 100 per cent renewables at times by 2025.

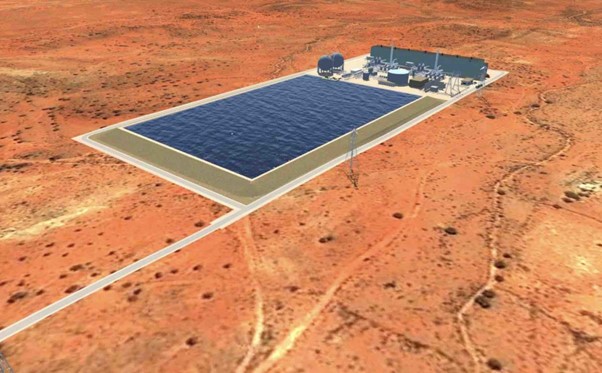

“Broken Hill Renewable Microgrid Revived after Transgrid Finds a Way to Dump Diesel” Giles Parkinson, Renew Economy, writes on 26th May 2022 about the renewable microgrid:

Plans to power the remote New South Wales mining city of Broken Hill with a world-first renewable microgrid have been revived after transmission company Transgrid found a way to dump the diesel option that it was being forced to adopt by Australia’s archaic energy rules and regulations.

The renewable micro-grid proposal is based around using – for the first time ever at such scale – a 200MW, 1500MWh storage facility using compressed air technology developed by Canadian company Hydrostor.

Those plans, first announced in 2020, were set to be dumped last year when Transgrid was forced instead to choose the installation of new diesel turbines because Australia’s National Electricity Market rules allow no consideration of environmental benefits.

In a strict definition of economic benefits, the highly polluting diesel generators won out over the cleaner energy storage option, but Transgrid and Hydrostor and its project partner Energy Estate have now revisited the plan and – helped by an anticipated grant from the Australian Renewable Energy Agency – believe it wins out over the dirty diesel option.

It’s a bold play by Transgrid. Historically, networks are not known for punting on new technologies over traditional poles and wires and other conventional options – partly because of the old fashioned rules that govern the market and discourage innovation. But Transgrid insists there is little risk to it or consumers, because the nature of the deal with Hydrostor means that the Canadian company and its partner won’t get paid if they can’t deliver the project. Hydrostor has “proven” the technology at pilot scale, but not yet rolled it out at commercial scale.

“We like non-network solutions,” Transgrid’s head of delivery, Craig Stallan, told RenewEconomy, adding that Transgrid will nevertheless “upgrade” two existing diesel generators at Broken Hill, at minimal cost, just in case.We only pay if it works, we only pay (Hydrostor) if that service is provided,” added Marie Jordan, Transgrid’s newly appointed head of network.

The decision to go with Hydrostor – if approved by the Australian Energy Regulator – will turn Broken Hill into a hot bed of edge-of-grid innovation, combing compressed air storage with the existing 200MW Silverton wind farm, the 50MW Broken Hill solar farm, and the newly committed 50MW/50MWh Broken Hill battery. The region has had more wind and solar generation than it knows what to do with, and has often struggled to export the full output of those facilities to the rest of the grid, resulting in heavy curtailment of the local wind and solar farms.

The addition of the shorter term battery and the longer term compressed air storage will maximise the renewables output, provide more resilience to the local grid, and provide a ready supply of plentiful cheap, clean and reliable green energy for the mining and minerals processing industries that are expected to revive the local economy.

The latest project assessment estimates $268 million of economic benefits from the Hydrostor option, which Transgrid says is a 5 per cent better return than installing two new 25MW diesel generators, and Transgrid notes new investment in fossil fuels is less desirable given the green energy transition happening elsewhere.

The “economic advantage” is, however, dependent on ARENA agreeing to a grant. The size of the requested grant has not been revealed, given it has not been agreed, but the document suggests at least $13.2 million will be needed to keep the storage option ahead. If the grant is not forthcoming, it will be back to the diesels.

Hydrostor plans to install the compressed air storage facility in an old mining operation, using abandoned caverns to store the compressed air which is released when needed to spin turbines and generate power. Hydrostor describes its technology as a “giant air battery”. It uses off-peak renewable electricity to run a compressor that produces heated, compressed air, which is then stored in underground caverns. When needed, the compressed air is expanded through a turbine to generate electricity.

“TransGrid understands the value offered by our A-CAES solution, and we are very pleased to have been selected as the preferred alternative over competing proposals,” said Hydrostor CEO Curtis Van Walleghem. New South Wales is a global leader with its clean energy policy and net zero ambitions and we are looking forward to commencing our first A-CAES project in Australia.”

Transgrid’s Jordan says the decision is in the long-term interests of consumers. “Hydrostor is proposing an exciting technology which would establish a mini-grid using compressed air storage in a disused mine, in conjunction with existing local wind and solar generation,” she said in a statement.

This initiative would represent an Australian first and the scale of it is impressive. As one of the largest renewable mini-grids to be created worldwide, we’d expect it to secure supply for Broken Hill and create at least 260 construction jobs and a further 70 ongoing roles after project completion.”

Disclaimer The comments and details in the articles in this newsletter do not reflect the views, policies or position of the Association or its member Councils and are sourced and reproduced from public media outlets by the Executive Officer to provide information for members that they may not already be exposed to in their Local Government areas

Contacts

Clr Michael Banasik (Chair) michael.banasik@wollondilly.nsw.gov.au 0425798068 or Greg Lamont (Executive Officer) 0407937636, info@miningrelatedcouncils.asn.au.

You must be logged in to post a comment.