Introduction

Delegates, here is the February MERC Newsletter, albeit a bit later than normal, please circulate the Newsletter to your fellow Councillors and senior staff, so they can appreciate and understand the excellent work the Association and you are doing on behalf of your Council and community, with regard to mining and energy related matters.

Passing of former Deputy Chair of MERC, Cr Lilliane Brady, OAM

The Association was represented at the State Funeral for Cr Lilliane Brady, OAM on 19th February in Cobar by the Chair (Cr Peter Shinton and Mrs Julie Shinton), Deputy Chair (Cr Owen Hasler) and the Executive Officer (Greg Lamont) for the former Mayor who was a formidable opponent, a dynamic advocate for mining related matters in NSW and a passionate worker for her community. It was attended by over 1500 community members, peers, colleagues and supporters.

It was a fitting farewell for Lilliane with her children Paddy, Deirdre, Susan and their children present, also attended by many dignatories including the Deputy Premier (Hon John Barilaro), Federal Minister for Local Government (Hon Mark Coulton), Minister for Local Government (Hon Shelly Hancock), Minister for Agriculture & Western NSW (Hon Adam Marshall), Local Members of parliament-Roy Butler (Barwon), Dugald Saunders (Dubbo), Mayors and councillors and government agency senior staff, from all over the state. The Cobar Shire Council staff formed a guard of honour for their long serving much loved former Mayor, Cr Lilliane Brady, OAM..

COVID-19 Virus Impact on MERC

The NSW Government continues to work very closely with Councils to support communities across the state in response to COVID and the changing hotspots. Consequently, there will be changes as circumstances alter that will affect MERC and members going forward due to the NSW Government’s respective Ministerial Public Health Orders to implement controls as necessary to combat the COVID virus. If there is a resurgence of the virus from time to time the 2021 meetings may be affected, however the Gunnedah meeting will be a normal meeting at this stage.

Two year terms and Nominations for Executive Committee

MERC has deferred consideration of appointments to the Executive Committee for two year terms until after November 2021 when new councils and delegates are appointed and they can determine if MERC needs to do this or not.

The wording in Clause 7.1 of the constitution on the composition of the Executive Committee on whether two from any one member Council can be on it, was considered at the Special General meeting on 26th February 2021 where it adopted the following wording:

“The Executive of the Association shall comprise the Chairperson, two Deputy Chairpersons, if such delegates are willing to accept nomination; and three (3) other delegates as the Association shall from time to time determine necessary. All delegates appointed to the Executive Committee must come from separate member council areas”.

Next Meetings for the Association in 2021

The next MERC Ordinary meeting will be as a “face to face” meeting at Gunnedah on 21st May 2021 preceded by a tour in the afternoon, with networking dinner that evening on 20th May 2021 either in a restaurant or a BBQ yet to be finalised but a must see and do event.

The Executive Committee will have a zoom meeting before the Ordinary meeting on 21stth May (to be finalised by Executive Committee). A zoom meeting for the Ordinary meeting will be dependent on the NSW Covid position with Public Health Orders that end in March 2021.

This meeting round in May could be the last meeting for the year until November when the AGM has to be held, as the scheduled August meeting will either be cancelled or brought forward to July, in view of the caretaker situation of councils in August, due to the September Local Government elections.

Gunnedah has accommodation however it is very popular due to the extensive mining and rural activities in the area, so delegates are encouraged to book early. A list will be forwarded to delegates when to hand.

Membership Campaign

MERC will be participating in the 2021 LGNSW Annual Conference in November with stand, attend dinner, target/talk to potential members, to include pamphlets, notepads with “We are your voice – become a member” or suchlike (badges) on them for handouts, a banner indicating locality of members throughout NSW, a video to play on a laptop to link back to the webpage, set up a membership page on the website, etc, relying on “face to face” conversation and relationship selling.

A membership page has been established on the website with a facility to contact the Association for more details, encouraging membership.

List of Speakers for future meetings of MERC

MERC will be continually pursuing the following speakers for future meetings

- Hon Rob Stokes, Minister for Planning & Public Spaces, Liberal Party;

- Hon Matt Kean, Minister for Energy & Environment, Liberal Party;

- Hon John Barilaro, Deputy Premier, Minister for Regional NSW, Investment & Trade, Leader of NSW National Party;

- Hon Adam Marshall, Minister for Agriculture & Western NSW, National Party;

- David Shoebridge MLC (Energy) & Abigail Boyd MLC (Mining), from The Greens;

- Other relevant Opposition party members and government senior officers will also be pursued for meetings as required depending on locality of the meetings – Shadow Minister for Local Government (Greg Warren) keen to address delegates post COVID;

- Leader of Shooters, Fishers and Farmers Party in Legislative Assembly & MP for Orange, Phil Donato;

- Relevant Senior Departmental Executives;

- CEO’s, Clean Energy Council and Clean Energy Finance Corporation, ARENA, and various renewable energy speakers, etc.

- Business and Industry leaders that have matters of interest for members.

Speakers for the 21st May 2021 being pursued are Minister for Agriculture and Minister for Western NSW, Hon Adam Marshall, a EPA Senior Officer from the Armidale Office, NSW Minerals Council CEO Steven Galilee and Geni Energy principal Rohan Boehm.

Research Fellowship Update

Unfortunately, the PhD project has come to an end. As outlined in this statement from Peter Dupen, PhD student, UTS:

“It is with deep regret and genuine sorrow that I finally admit defeat on our common cause to test the concept of using participatory modelling in an early stage of a mining or energy proposal to identify stakeholder thresholds of concern. Despite all of your support and our best collective efforts, we have not been able to identify a suitable project in which the proponent is willing to participate – no one wanted to be the first to trial this novel process and risk unnecessary focus through a novel stakeholder engagement process.

My supervisors and I are very grateful for the support that you and your organisations have provided to this quest. I personally remain convinced that the concept of identifying stakeholder thresholds of concern prior to EIA evaluation has procedural merit and I am optimistic that we can find a way to progress it less directly. We propose that the next step is for my supervisors and I to prepare a draft paper in consultation with any of the sponsors willing to review and edit, and that we then seek to get this paper published in a professional EIA-focussed journal. By placing the theoretical base of the process in front of planning professionals, we may yet find a way to introduce this important concept into future planning processes.

As no sponsorship money has been collected, we are in the fortunate position of not having to refund any. I regret that I am not able to refund your time and energy but I hope that you will agree with me that the journey here has still been worthwhile though ultimately unsuccessful in this format.

Please let me know if you would like to discuss any points above or more generally, or if you have any further ideas about how our collective aims to improve planning assessment processes may be otherwise met”.

It was resolved at the meeting on 26th February 2021 that a letter be forwarded to Peter Dupen to thank him for his efforts in trying to get this project up and running and his perseverance, wishing him well for the future. The Executive Officer will forward documentation on participatory modelling from the PhD student (when received) to all members as information on the project; and Steve O’Donahue, Director – DPIE, be advised that MERC is still keen to work with DPIE on PhD projects like “participatory modelling” that Peter Dupen was working on with their continued support, despite the difficulty he had in getting proponents and councils to participate to launch it. It certainly was an eye opener when dealing with the funding requirements of the university involved which also a contributor to the demise of the project.

The partnership with CRC for Transformations in Mining Economies (CRC TiME) and any universities in the future may enable this project or ones like it to be delivered as opportunities present themselves. Any leads will be favourably received and followed up. “Great discoveries and improvements invariably involve the cooperation of many minds” Alexander Graham Bell.

Strategic Plan 2020 – 2023 Review

The Strategic Plan 2020-23 Strategic Directions, Deliverables and Actions were adopted by delegates at the Ordinary meeting on 27th November 2020 and is full of new strategies to be implemented over the next three years which will hopefully help with membership growth and involvement of members. It is on our web page for reference.

Renewable Energy Zones

The NSW Government is implementing three pilots and one of them is the 3,000 megawatt Renewable Energy Zone (REZ) in the Central West of NSW as part of their Electricity Strategy, Net Zero Plan and the Commonwealth-NSW Memorandum of Understanding on Energy and Emissions.

The NSW Government released the Electricity Infrastructure Roadmap and introduced supporting legislation in Parliament in 2020. Refer-(https://energy.nsw.gov.au/government-and-regulation/electricity-infrastructure-roadmap).

The Roadmap is a landmark policy for NSW and Australia. It is a comprehensive and coordinated framework that will guide NSW through the energy transition, delivering an affordable, reliable and sustainable energy future for the people of NSW. The Roadmap is expected to reduce household energy bills by $130 each year, support 9,000 jobs, drive $32 billion in investment and make a significant contribution to the State’s net zero targets.

This is especially exciting news for the Central-West Orana REZ because it increases investment certainty for generation and transmission projects and will encourage local jobs and content. The NSW Government has also announced a Renewable Manufacturing Taskforce to help develop local and sustainable supply chains for the infrastructure for REZ see: https://www.nsw.gov.au/media-releases/manufacturing-renewables-taskforce-to-boost-regional-jobs-and-local-industry”

The last meeting of the Central West REZ Reference Group was on 22nd February 2021 in Dubbo, minutes will be distributed to delegates when to hand. For more information about NSW REZs please visit www.energy.nsw.gov.au/renewable-energy-zones, or email the team at rez@planning.nsw.gov.au.

MERC resolved on 26th February2021 that the Executive Officer seek clarification on the name of the “Central West Orana REZ” on the basis that it is more representative of Orana than the Central West when one looks at the zone map and suggests consideration be given that it be re-named to Orana REZ.

Rating Review by LGNSW – IPART Review Recommendation 34

Further to the information raised with the Productivity Commissioner on 14th August 2020, MERC distributed the IPART report and State Government’s response, it was discussed further by delegates on 27th November 2020, since then the Executive Officer has been in contact with LGNSW about their rates modelling and actions since the LGNSW Conference.

The link for the background document, media release and the draft bill, consultation process, etc is bleow, click on it. Please read it and assess how your Council may be affected if implemented.

https://www.olg.nsw.gov.au/councils/policy-and-legislation/fairer-rating-system-consultation/

Delegates had raised their concerns about the possibility of the State Government passing legislation that will have a negative impact on Councils with mining rating. MERC provided a submission based on the comments made at the Blayney meeting, the Motions passed at the LGNSW Conference and input from rating personnel where required.

In discussions with the Deputy Premier and Local Members of Parliament on 19th February 2021 in Cobar, delegates were concerned that mining affected LGA State Members of Parliament representatives were allegedly not aware of the “Towards a Fairer Rating System Review” being undertaken by the Office of Local Government and the mining rate issues.

MERC at its meeting on 26th February 2021 resolved to do something about this by requesting the Executive Officer forward the MERC submission and the 2014 submission by Blayney Shire Council on the mining rating reviews be referred to Deputy Premier & Minister for Regional Development (Hon John Barilaro); Minister for Agriculture & Western NSW (Hon Adam Marshall); Member for Orange (Phil Donato); Member for Dubbo (Dugald Saunders); Member for Barwon (Roy Butler) for their information and attention, so they are aware.

Related Matters of Interest – Mining and Energy Issues

“Australia cannot afford to allow coal generators to hijack clean energy transition” 26/2/21. Renew Economy, Dan Cass writes: The federal government has made much of its “face off” with Big Tech in the showdown over digital media, but do Australian governments have the courage to take on the coal lobby, in the big energy showdown of our era? In 2019, Australian governments charged the Energy Security Board (ESB) with the daunting task of making the National Electricity Market (NEM) fit for purpose in this age of renewable energy and climate action: the ‘Post 2025’ project.

The challenge is that the NEM was designed around coal. Australia must remake the system so it will deliver affordable, reliable electricity generated by solar, wind and water. Like the tensions that run from Canberra to the Hunter, the redesign is another frontier between clean and dirty energy. Coal dominates the NEM and it is being outpriced by renewable energy.

Coal generators want to hold back competition and block or at the very least delay any reforms that accelerate the clean energy transition. The economics of electricity are a zero-sum game for generators. If clean wins, coal loses. Australia’s private owned coal generators, including the dominant retailers AGL, Origin and Energy Australia, are facing billions of dollars in write downs.

They gambled on being able to retire their coal fleets in the 2030s. This is looking increasingly risky. Recent research shows that some will retire years earlier than their owners are admitting. ESB Chair Kerry Schott says five coal power stations will be loss-making by the time the redesign in implemented in 2025.

This is backed up by a study which suggests that coal generators revenues could fall by as much as two-thirds by 2025. David Leitch predicts that in addition to Liddell, Yallourn, Vales Point and some Queensland generators could all close by 2030. Now the whisper campaign from coal central is that its all about to ‘coalapse’ in a heap. The market has failed and we need to step in and, wait for it, pay loss-making coal generators to stay around.

This will have three impacts. Firstly, it keeps emissions high. Secondly, it will push prices up. Thirdly, it creates new reliability challenges because soon the daytime peak of solar production will push all coal generators down to their minimum safe operating level. If all the coal fleet is at its minimum output, it has zero downward flexibility.

If demand drops suddenly on a hot day in summer, or the wind blows much harder than predicted, coal will have nowhere to go but off a cliff. Coal units will have to be shut down at a moments notice. Coal is holding the NEM reform process hostage. The coal lobby has held back sensible reforms like demand response for years and now the NEM is in a tricky place, overly reliant on a coal fleet we cannot rely on anymore.

So what should the ESB, governments and NEM wonks do now? First, turn away from the incumbents and to new entrants and innovators to provide the new ideas. We only ‘need’ coal because we have not designed a post-coal NEM yet. Let’s get on with it. Secondly, work out what the NEM needs. It does not need more ‘baseload’, which is inflexible and incompatible with high levels of wind and solar. The resource adequacy gap will be filled by building new, flexible resources and paying customers who support the grid during extreme events. This is probably going to be batteries, batteries, batteries early on. From 1 October this year wholesale demand response will evolve and ARENA can continue to drive innovation there until we have a mature market in ‘negawatts’.

Thirdly, we need to forget the rent-seeking arguments of the coal generators and agree on a tight set of clear design principles that everyone else can agree with. Here are three to get the ball rolling:

- Competition: prevent the coal and gentailer companies that dominate the generation and retail markets, from dominating the essential system services market;

- Technological innovation: drive new technological solutions, which will improve security and reduce cost

- Federated planning: States are taking the lead with comprehensive REZ investment, planning and procurement policies and the national market in essential system services must accommodate each state’s energy priorities

We can not afford to allow coal generators to hijack the clean energy transition. The ESB and in particular its independent chair Kerry Schott and deputy David Swift should know that Australia has their back. The 2020s will be all about increasing climate ambition and propping up coal should be the last thing on the NEM reform agenda. Refer www. reneweconmomy.com.au

“Two rural towns could go off the grid” 26/2/21, Renew Economy, James Fernhough writes: “Two regional Victorian towns, Donald and Tarnagulla, are to take part in a trial with a local network operator that could see them become the biggest communities so far to cut ties with the grid and rely on local renewables and storage. The trial is being co-ordinated by the Centre for New Energy Technologies (C4NET), an initiative founded by the Victorian government that aims to bring business, communities and research organisations together to find innovative ways of decarbonising electricity supply.

A new rule change working its way through the system will allow network operators to service remote customers, such as farms, with “stand alone power systems.” But it will also be applicable to larger communities, and Donald and Tarnagulla, could be the first in line. See: Off the grid: AEMC paves way for stand alone systems to replace poles and wires

Both towns are located near Bendigo but are at the end of long rural power lines, which apart from being costly to maintain, also carry risks of failure due to storms, bushfires and dust. It is clear that solar and storage offers a cheaper and more reliable option, and the regulatory barriers are now being removed.

Other towns in Victoria, such as Yackandandah and Newstead, have been talking about sourcing 100 per cent renewables for their electricity needs, but within the overall grid structure. Other communities, such as Mallacoota, hit by last summer’s bushfires, are also considered candidates to go off-grid. It has already benefited from a new battery.

C4NET chief executive James Seymour said the aim of the trial was primarily to learn about how microgrids can be used, and to apply that knowledge more widely. He said the towns were chosen primarily because the communities were already actively engaged in the energy transition. “The findings are all public,” he said. “If more towns can solve their challenges with microgrids in future and do it more efficiently because they’ve been informed by the study, then fantastic.”

If successful, the towns, which are both west of Bendigo, could be cut off from the main grid altogether, with a combination of solar generation and battery storage the most likely replacement energy source – although Seymour was keen to stress C4NET had an open mind about the outcome of the three-year trials.

Any microgrid, though, would likely use distribution network operator Powercor’s existing distribution infrastructure in the towns. Powercor is actively involved in the study. Seymour said there were potential cost savings to distributors in creating microgrids in more remote communities. “The economics are changing. It’s increasingly expensive to maintain a reliable supply to regional and rural communities, because of things like bushfire mitigation, vegetation management, asset management, and also changing supply dynamic. The generation capacity is changing. But all of those are opportunities,” he said.

However, he said there were regulatory hurdles that made it difficult focus on anything but reliability of supply, and those rules would have to change. “The regulatory framework does not incentivise solving for a community’s need, it takes a ‘grid as a whole’ approach. That was entirely correct for the grid that we used to have. But let’s project forward for what the grid could be in the future, and it doesn’t have to be that.”

Along with C4NET and Powercor, the Central Victorian Greenhouse Alliance and renewable infrastructure company Ovida are also involved in the study. The three-year study is part funded by the federal government’s Regional and Remote Communities Reliability Fund. It will begin consulting the community at local forums next week. Both towns are very small. According to the 2016 census, Donald has a population of 1,498, and Tarnagulla has a population of just 133.

Powercor’s head of network strategy and non-network solutions Greg Hannan said the purpose of the forums was to study how the town uses energy, and whether its demands could be better met by a smart microgrid. It will also look at the potential cost-savings and improved reliability of doing away with feeder lines. “The future of energy is being driven by customer choices and Powercor has a big role in enabling them,” Mr Hannan said.

“This study will look at how we can best plan and structure microgrids to get the best outcomes for customers, communities and our environment .“Understanding what customers want, need and expect is a critical step in the planning.”

The announcement comes as another small town in Gippsland also begins a three-year study to see if a micro-grid can improve its energy security and prices. See: Gippsland town volunteers for micro-grid trial to reduce dependence on main grid

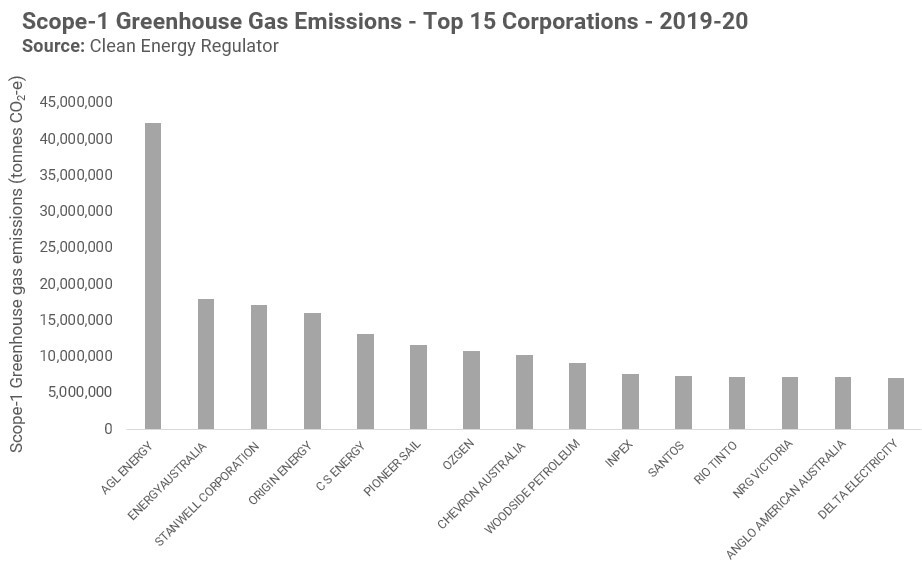

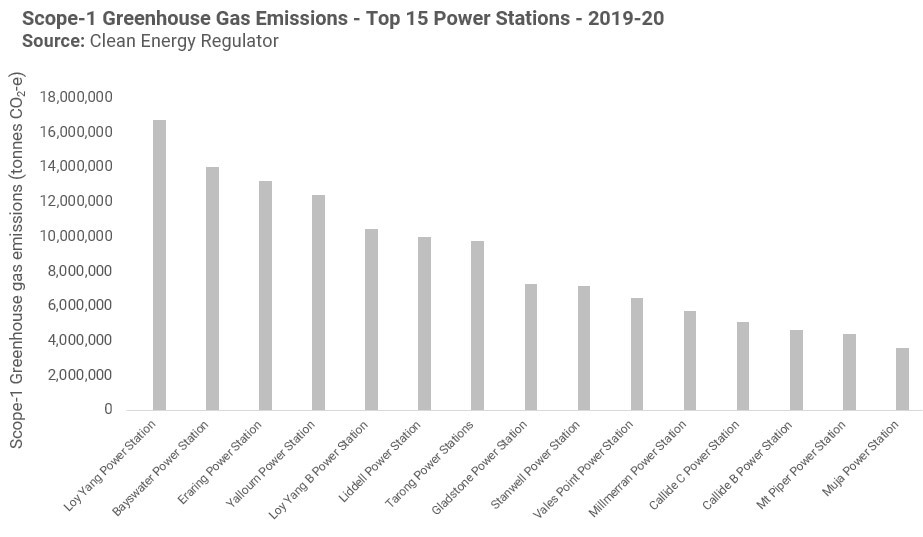

“Australia’s big energy companie’s largest emitters” 24/2/21, Renew Economy, Michael Mazanberg writes: Australia’s big energy companies have again ranked as the country’s largest emitters, with the operators of Australia’s coal fired generators dominating the latest list of the dirtiest companies. The Clean Energy Regulator published the latest batch of emissions and energy data collected under the National Greenhouse and Energy Reporting scheme (NGERs), outlining the emissions footprints of more than 400 of Australia’s largest emitters.

AGL has again ranked as Australia’s largest corporate greenhouse gas emitter, reporting scope-1 emissions of 42.2 million tonnes in the 2019-20 financial year, more than double the next highest emitter. Australia’s ‘big three’ electricity companies dominated the top of the list, with EnergyAustralia, the second largest emitter, reporting emissions of 17.9 million tonnes for the year, with Origin Energy ranking fourth at 16 million tonnes.

The Queensland government owned generators Stanwell Corporation and CS Energy ranked as the third and fifth largest emitters respectively, responsible for a combined 30.3 million tonnes of emissions. Oil and gas producers also ranked highly, with Chevron Australia reporting emissions of 10.2 million tonnes, Woodside Petroleum reported 9.2 million tonnes of emissions and Santos produced 7.3 million tonnes during the 2019/20 financial year.

Energy intensive resources companies, including Rio Tinto, Anglo American Australia, South32, Glencore, Alcoa and BlueScope all ranked amongst the top 20 largest emitters.

AGL topped the list, recording significantly higher emissions than any other Australian corporation, by virtue of owning Australia’s two largest emitting power stations, the Loy Yang A brown coal power station (16.7 million tonnes) and Bayswater black coal Power Station (14.0 million tonnes). It also owns Liddell. AGL Energy was responsible for around 8 per cent of Australia’s total greenhouse gas emissions.

Greenpeace Australia singled out AGL Energy due to its ranking as, by far, Australia’s largest emitter saying the energy giant needed to reconsider the role of coal in its generation portfolio. “Australians are on the frontline of the climate crisis which is primarily driven by the mining and burning of coal, and now AGL has emerged as the biggest climate polluter in the country,” Greenpeace Australia Pacific campaigner Glenn Walker said. “Australians who get their energy from AGL have done so in good faith, trusting that AGL is living up to the marketing reputation it has created, but this data reveals that behind the sleek, modern veneer AGL is still using dirty and dated methods to provide Australians with electricity.”

“Two out of three of AGL’s coal-burning power stations are set to close well beyond what scientists are calling for in order to prevent further catastrophic climate change. In order to protect Australians from the worsening impacts of climate change, all of AGL’s coal-burning power stations need to close by 2030 at the latest and be replaced by clean and safe renewable energy,” Walker added.

Responding to the report, a spokesperson for AGL Energy said the company recognised its responsibility to support investment in lower emissions energy sources. “AGL understands its responsibility as Australia’s largest energy generator and retailer to drive the transition to a cleaner energy future, while maintaining reliable and affordable energy for our customers,” an AGL Energy spokesperson told Renew Economy.

“Last year, we released our Climate Statement comprising five key commitments and our target of net zero emissions by 2050. Our statement provides an important framework that will guide our future actions and growth, recognising that customer demand, community expectations and technological advancements are the core drivers of Australia’s energy transition. AGL has published dates for the closure of our coal-fired power stations. We remain committed to these and the transition plans while progressing investments for projects that transition our portfolio,” the spokesperson added.

The Clean Energy Regulator noted that there had been some reductions in emissions across various sectors in the 2019-20 year, which mostly covers a period leading up to the impacts of the Covid-19 pandemic. Emissions from the electricity sector fell 7.5 million tonnes compared to the year prior as falling demand and increased generation from wind and solar projects push more emissions intensive plants out of the market. Emissions from the oil and gas sector also decreased by 3.4 million tonnes, due to reduced venting and flaring of gas.

The latest quarterly update to Australia’s greenhouse gas emissions, covering the period to the end of September 2020, are due to be published by the end of February.

“Collapsing thermal coal price pushes miners deep into the red” 15/2/21, Renew Economy, James Hernyhough writes: “Whitehaven Coal has become the latest Australian miner to announce massive losses as the collapsing thermal coal price continued to wreak havoc on the industry. In the six months to December, Whitehaven lost $94.4 million. It comes a day after BHP revealed it was writing down the value of its thermal coal assets by $US1.6 billion, while Anglo-Swiss miner Glencore – the biggest coal exporter in the world – lost more than $US500 million on it Australian thermal coal business, also thanks to write-downs.

The miners say losses were driven by a pandemic-induced drop in demand and China’s decision to ban Australian coal imports. That added to the global shift away from thermal coal towards low-emissions alternatives. The COVID effect seemed to fall away towards the end of the year, and that pushed thermal coal prices back up. BHP put this down to a “pick-up in demand due to cold weather in North Asia and a bounce in Indian industrial activity”. But BHP warned China’s imports policy was a “key uncertainty”.

The uncertainty may also extend beyond China’s imports policy to its domestic energy policy. Earlier this month a team of inspectors from China’s environment ministry heavily criticised the National Energy Agency for failing to implement President Xi’s “thoughts on ecological civilisation” when approving new coal-fired power stations. The report suggests the central government is clamping down on new coal power developments, following a period of relaxation, as it ramps up its efforts to reduce emissions and meet its pledge to reach net zero by 2060.

As AGL’s half year results showed last week, Australian power generators are struggling to make any money at all out of coal-generated electricity thanks to the rapid rise of renewable capacity, and that is also driving the push away from thermal coal. It’s a global trend which is moving rapidly in one direction.

With Australia’s other key export markets – Japan and South Korea in particular – also ramping up their emissions reduction plans, diversified miners are aggressively switching away from coal. BHP has effectively given up on thermal coal, and is in the process of ditching the high-carbon commodity in favour of minerals needed in renewable energy and electrification – in BHP’s case iron ore, copper and nickel. Whitehaven, though, remains totally dependent on coal.

Just as markets are threatening to dry up, so is investor capital. A long list of major lenders and institutional investors – including all of the big four banks – are one by one announcing they will no longer lend to or invest in pure play thermal coal companies. Insurers are also refusing to insure them.

The prognosis for pure play coal miners like Whitehaven couldn’t me much grimmer, especially since 85 per cent of the coal it exports is thermal, and only 15 per cent is metallurgical. But in a pre-recorded speech, Whitehaven’s CEO Paul Flynn tried to remain upbeat, insisting the price of coal would recover as the COVID-induced downturn ends.

“In the latter part of the half there was a strong rebound in prices, and we are increasingly optimistic that underlying market dynamics are supported by robust demand,” he said. He made no mention of the rapid global shift away from coal as a source of power. There was also no mention of either climate change or emissions in any of the material the company published on Wednesday.

In Whitehaven’s 2020 annual report, released late last year, the company made some basic comments on climate change. Last year the company did release a 74-page sustainability report. In that, its main argument was that its coal is higher quality than thermal coal from other parts of the world, and could therefore help coal dependent countries reduce their emissions somewhat.

Disclaimer The comments and details in the articles in this newsletter do not reflect the views, policies or position of the Association or its member Councils and are sourced and reproduced from public media outlets by the Executive Officer to provide information for members that they may not already be exposed to in their Local Government areas

Contacts

Clr Peter Shinton (Chair) peter.shinton@warrumbungle.nsw.gov.au 0268492000 or Greg Lamont (Executive Officer) 0407937636, info@miningrelatedcouncils.asn.au.

You must be logged in to post a comment.