Introduction

Delegates, here is the MERC September Newsletter, please circulate the Newsletter to your fellow Councillors and senior staff this week, so they can appreciate and understand the excellent work the Association and you are doing on behalf of your Council and community, with regard to mining and energy related matters.

Next Meetings of Association. In trying to get the next MERC AGM meeting in Sydney, NSW Parliament House during parliament sitting times in Jubilee Room is becoming difficult due to the renovations going on. Next sittings of parliament are Tuesday-Thursdays on 21st–23rd and 28th-30th November 2023 and only suitable day that didn’t clash with member’s monthly meetings was 30th November, but the Jubilee has been booked on that day. The other option was the following week but because parliament is not sitting (albeit 5th– 7th December is reserved for a sitting) the Jubilee Room not available these days due to renovations.

The option to go back to the Club York rooms in Sydney is still a consideration to get Ministers to address delegates. The Executive Committee will shortly decide once they finalise their deliberations on the expressions of interest for the provision of Executive Officer services and the external review reports by Future Together Group & Three Pillars Advisory are analysed.

Future 2024 Forum (REIIF) The REIIF date slots have been temporaly booked for next year in the week 5-7th June 2024 but only over 3 days. The delegates at Ordinary meeting on 3rd August confrimed that the conference will be run in partnership with RDA Orana with MERC’s Ordinary meeting being held on first day 5th June 2023, followed by site visits, networking dinner in evening, then a conference day for councils, politicians, experts and having non members and potentially new members attend as observers, then the business/industry day is on 7th June 2023. Awaiting confirmation on who the next CEO is at RDA Orana to lock in the REIIF for 2024 nad start preparations to make it a bumper event.

COVID-19 Virus Impact on MERC – In 2023 MERC will be resuming its’ meeting cycle activities in the normal manner. What this means for MERC delegates is that 2023 will have quarterly meetings as “face to face” meetings with use of zoom in exceptional circumstances. Executive Committee meetings will be by zoom means as determined. A lot of value is gleaned from being at a meeting in person and this can be lost when delegates attend by zoom. The focus will always be on giving delegates an opportunity to attend meetings. However, delegates must be present to vote for the AGM in view of the voting system in the constitution.

Speakers for Next Meeting in Sydney – The Ministers for Natural Resources, Planning, Climate Change, Energy, Treasury & Local Government will be approached to speak at next meeting once the meeting day has been determined.

Inland NSW Growth Alliance (INGA) (formerly Orana Opportunity Network – O2N) – MERC is trialling as a Bronze Member of INGA for 12 months. Their Newsletters are available on their website on rdaorana.org.au.

CRC Transformation in Mining Economies (CRCTiME) Post Mining – MERC is a partner with CRC TiME on a no cost but consultative basis. They provide quarterly updates on progress with an opportunity for members to join webinars, workshops, surveys etc. See Website www.crctime.org.au

Executive Officer Services Replacement Update. The Executive Committee has commenced the process for an entity to provide Executive Officer services, utilising LGNSW Management Solutions to help with the engagement. The current Executive Officer has not been involved in any shortlisting or the interview process which is being dealt with by the Executive Committee and Local Government Management Solutions, so if there are any enquiries in relation to the process or who is being interviewed and so forth, please refer to the Chair, Cr Kevin Duffy, Orange City Council, contact details are at the end of this newsletter.

Engagement of Future Together Group (FTG) & Three Pillars Advisory. MERC has engaged Martin Rush and Amer Hussein from FTG and Three Pillars Advisory to undertake a review of MERC as follows:

- (1) Review and refresh MERC’s value proposition, sharpen the future strategic planning review processes and membership derived value.

- (2) Review Constitution to:

- Support organisational effectiveness.

- Facilitate greater membership and external cut through.

- Enhance direct and in-kind resourcing.

- (3) Develop a Policy Platform Structure Plan:

- A policy gap analysis – Local Government Interest in mining & energy.

- Prioritisation of policy – relevance to current and/or prospective members.

- A policy and position paper roadmap in short-medium term.

- (4) Update MERC Financial & Resourcing Plan.

The Reports have been received from Three Pillars Advisory for Items 1, 2 & 4 and FTG for item 3. The recommendations are many and will be assessed by the Executive Committee in due course. It is a timely review with new State Government and councils grappling with issues associated with the roll out in some areas of renewable energy developments and a new Executive Officer services provider for MERC. Meantime, current arrangements are continuing with the provision of Executive Officer services.

RDA Orana

Whilst the Central-West Orana Renewable Energy Zone (REZ) during this early development stage has many benefits, it also has many challenges. The project is expected to bring up to $5 billion in private investment to the region by 2030. At its peak, the REZ is expected to support around 6,000 construction jobs in the region, however this could be as high as 8,000. As the project moves forward, the finer details are being established. Following a Central-West Orana REZ Steering Committee meeting last week, terms of reference were finalised for four new working groups: Accommodation, Environmental, Roads and Transport, and Social.

Resources for Regions (R4R)

Members in receipt of current R4R would be aware by now that in the recent NSW Government Budget the program is not available for 23/24 budget and onwards. However, it is understood that the Regional Development Trust fund of $350m has been established to replace this program and others, with the details yet to be developed. (MERC to apply to be involved). Note the following media release from Department of Regional NSW Minister Tara Moriarty’s office:

“The Minns Labor Government is delivering on its commitment to regional NSW communities by ensuring they receive their fair share of funding with a $350 million boost to the new NSW Regional Development Trust Fund and by reforming the Regional Development Act to better reflect their needs.

This Trust defines a new approach to supporting people living in rural, regional, and remote areas. The Trust will focus on improving the wellbeing of people, by improving local amenities, social cohesion, and job opportunities. Funding decisions of the Trust will be guided by a new Regional Development Advisory Council that will also play a key role in engaging communities to update the Regional Development Act. This legislation requires a makeover so it can better deliver on its economic and social growth objectives. As part of the reforms, the NSW Government will:

- seek community input on updating the Regional Development Act 2004 to better reflect the priorities of regional and remote communities.

- make a starting investment of $350 million into the Regional Development Trust.

- establish the Regional Development Advisory Council to provide governance and expert advice on the priority matters requiring the Trust’s investment and advising on the reform of the Regional Development Act. The Regional Development Trust Fund will strategically invest in four focus areas:

- Sustainable regional industries, including emerging and engine industries.

- Aboriginal economic development and enterprise.

- Community infrastructure and capacity building.

- Improving regional service delivery.

Decision making on investment from the Trust will be guided by the investment principles of the Australian Government’s Regional Investment Framework. Establishment of the Advisory Council and public consultation on reforming the Act will get underway as soon as possible. Minister for Regional NSW and Western NSW Tara Moriarty said: “These reforms to grant funding and the Regional Development Act demonstrate our government is putting the needs of regional people at the heart of our decision making. Our communities deserve this after a decade of waste, pork barrelling and poor results. “We are committed to ensuring rural, remote, and regional communities not only get their fair share but that we are making a real and positive difference to their lives, towns and businesses. “We are also committed to distributing funds to where they are needed most.”

Mining & Renewable Energy articles

“NSW Coal Royalties Hike” Industrial Careers article states: “The NSW government is set to bolster its budget by $2.7 billion through an increase in coal royalties. However, the move has drawn concern from the mining sector due to what it labels a “significant additional tax burden” amid challenging market conditions.

Starting from July 1, 2024, NSW will raise coal royalties by 2.6 per cent for open-cut, underground, and deep underground mines, resulting in rates of 10.8 per cent, 9.8 per cent, and 8.8 per cent, respectively. The government expects this adjustment to inject over $2.7 billion into state funds over the next four years.

The decision follows consultations with industry stakeholders, aiming to strike a balance between maintaining a robust mining sector and serving public interests.

Finance and Natural Resources Minister Courtney Houssos emphasised the significance of coal to the state’s economy and electricity supply, saying the state had “struck the right balance”.

However, the NSW Minerals Council has expressed apprehension about the increased royalty rates, particularly as the coal industry grapples with escalating operational costs and falling coal prices. Stephen Galilee, CEO of the NSW Minerals Council, noted that these rate hikes could effectively amount to a 30 per cent increase in proportional terms, posing a considerable challenge for the sector.

Despite these concerns, the industry expressed relief that NSW did not adopt Queensland’s sliding scale royalty system. The changes also mark the first coal royalty increase in NSW since 2009 and are intended to offset a $1.3 billion royalties revenue write-down in the forthcoming budget.

Coal remains a critical export commodity for NSW, supporting thousands of jobs and playing a significant role in the state’s energy landscape. The government aims to balance the industry’s needs with the state’s fiscal requirements while allowing time for adaptation before the changes take effect in 2024”.

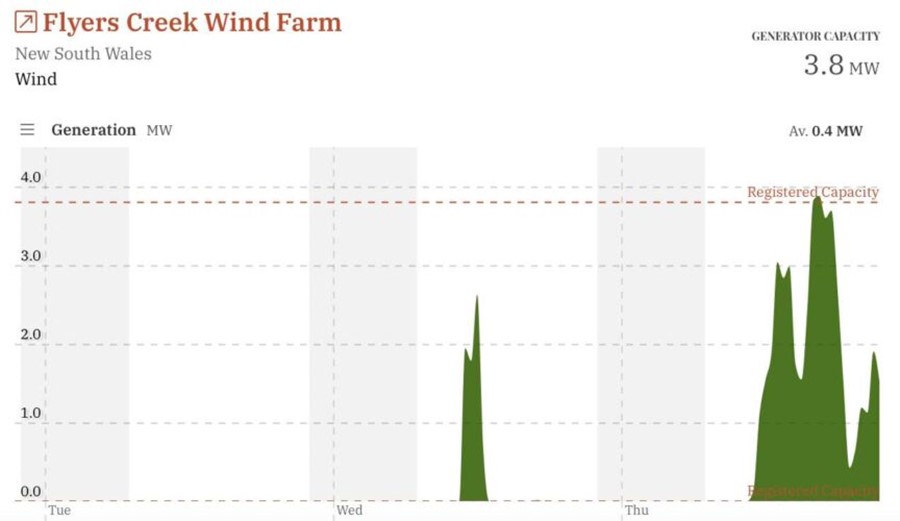

“New NSW Wind Farm Sends First Bursts of Power to the Grid” Rachel Willamson, Renew Economy, 21st September writes “After 11 years in the development pipeline, the still-under construction Flyers Creek wind farm sent its first power to the grid on Wednesday.

The Iberdrola project generated very small amounts of power between 11am and midday, and on Thursday was switched on again at 11am as it works its way through the commissioning process. This involves working through various “hold points” and the 145 MW Flyers Creek wind farm is currently limited to an output of just 3.8 MW.

An Iberdrola spokesperson told RenewEconomy that it’s a small milestone for the wind farm, located near Orange in the state’s Central West. “Of the 38 turbines that will comprise the wind farm, three are currently complete and capable of generating power, an additional 18 are mechanically installed with the blades now attached to the towers,” he said.

The project seemed cursed until Spanish giant Iberdrola picked it up last year through the purchase of Infigen Energy in 2021. Construction finally began in March 2022. Flyers Creek has been in the pipeline since 2012, when it received development approval. But financial close was deferred and delayed until COVID-19 arrived, and high costs killed the project off temporarily.

Infigen swore the project was still a goer, given its location close to a large electricity load and compelling wind resource, and Iberdrola clearly agreed when Flyers Creek appeared in its expanded portfolio.

Iberdrola hasn’t said how much it spent to bring the project to fruition, but an application in 2019 to modify the development approval showed Infigen had a $300 million budget to get it running. GE is supplying the 3.8 MW turbines which have a rotor diameter of 137 metres.

Source: OpenNEM.

Flyers Creek isn’t the only project capitalising on the prime Orange location. Some 40km to the north is the proposed Kerrs Creek wind farm, was originally pitched by RES Australia as a proposed 650 MW operation with 80 turbines, but has been reduced to a planned 441 MW, 63-turbine project.

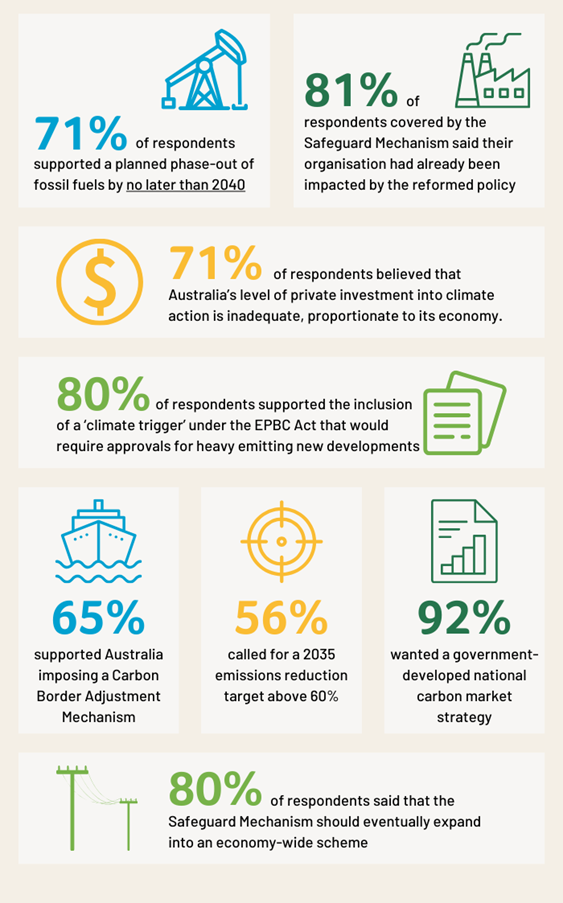

“Carbon Market Institute – Australian Business Climate Survey” We are pleased to share with you the results of our 8th Australian Business Climate Survey, and we would like to extend a big thank you to those who took the time to contribute. Following an eventful past 12 months in the climate policy, this year’s survey explores the impact of these reforms while also tracking business perspectives on Australia’s role in global efforts to address the twin climate and biodiversity crises. We share these results with you following the conclusion of our 10th Australasian Emissions Reduction Summit, which tackled many of the questions highlighted in the Survey. You can access our final Summit press release here. You can view key findings from the 2023 Survey and access the full report below.

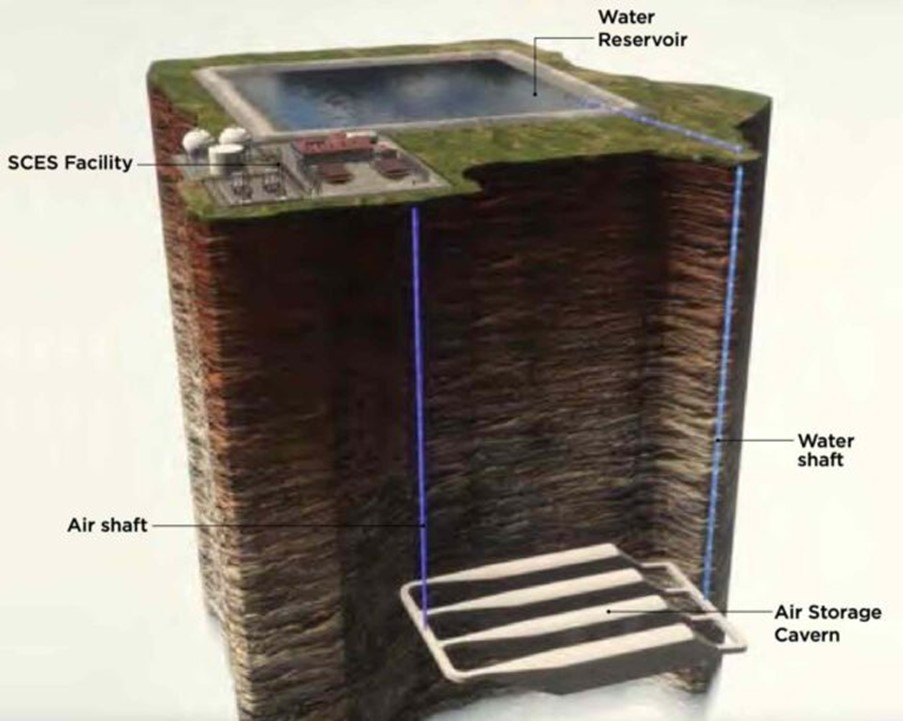

“Broken Hill Mine Offers Disused Cavern to Host World’s Biggest Renewable Air Storage Facility” Giles Parkinson, Renew Economy, 28th September 2023 writes “A disused cavern in the famed Broken Hill silver, lead and zinc mine is to play host to what will be the world’s biggest renewable-powered compressed air storage facility in the world, potentially offering a new form of long duration storage to support wind and solar.

Canadian start-up Hydrostor has signed a deal with Australian mining company Perilya to use a disused cavern at the Potosi mine to support the Silver City Energy Storage project, which will feature compressed air energy storage technology with a facility rated at 200MW and eight hours of storage, or 1600MWh.

The technology is one of a number of newly emerging competitors to pumped hydro to provide long duration storage, including various “gravity” storage technologies, and new variations of solar thermal technology such as RayGen’s newly commissioned plant at Mildura.

The Broken Hill project has been a long time in the making. It was first proposed in 2020, but as RenewEconomy reported in 2021, it was almost sidelined by Australia’s regulatory madness which nearly forced transmission group Transgrid to instead choose new diesel generators to replace the town’s ageing back-up generation.

In the end, the innovative clean energy alternative won out, but it does represent a bit of a punt, considering that Hydrostor abandoned an ARENA-funded project in a South Australia zinc mine because of its lack of scale, and only has a small 2MW, 10MWh facility in Ontario that has been operating since 2019 as proof it works. If the Broken Hill project is successful, it will be a showcase for the technology for the world.

Hydrostor says the Potosi mine has several key features, including very hard and impermeable metamorphic rock, an existing underground mine and infrastructure, and ideal depth (about 600 metres below ground). Hydrostor will get access to property, mine infrastructure, and construction support services, which will enable it to fast-track the process and reduce set up costs.And the deal is obviously delivering more value to the mine owners Perilya, which itself is now owned by Shenzhen Zhongjin Lingnan Nonfemet, one of China’s largest zinc producers.

The Silver City project will be used by Transgrid to provide backup power for Broken Hill and the far west region of NSW and is expected to provide reliable backup power for the town, as well as existing and new mining activities in the region.

The storage facility will set aside 250MWh of its 1600MWh capacity to back-up power under a contract with Transgrid, and use the remaining capacity to trade on the market on a daily basis – pumping and compressing air in the cavern when prices are low, and discharging when prices and demand are high.

CAES technology is not new, and there are large projects in Germany and the US, but these mostly use gas turbines to deliver the power to compress and heat the air, which is then stored in caverns, before being released and re-heated and expanded to drive more turbines.

Hydrostor’s technology differs from the others in that it is emissions free and uses a method known as hydrostatic compensation, where a head of water in the surface reservoir is used to maintain pressure. It claims a round-trip efficiency of more than 60 per cent, which is significantly less than pumped hydro (70-80 per cent), and battery storage (more than 90 per cent).

Renewable power is expected to be provided by the existing 200MW Silverton wind farm and the 53MW Broken Hill solar farm, both of which are often heavily constrained because of the lack of local demand and limits on the link to other consumers. AGL is also building a 50 MW/50 MWh lithium-ion battery at Broken Hill to support its operations there.

The Silver City project has been backed by the NSW Government under the Emerging Energy Program and by the federal government via a new $45 million grant from ARENA under its support program for long duration storage. Construction is expected to start in the middle of 2024 and be complete in 2027. The project is expected to provide 750 direct and indirect jobs during construction, and 70 ongoing jobs in operation, and is expected to contribute more than $1 billion to the regional economy.

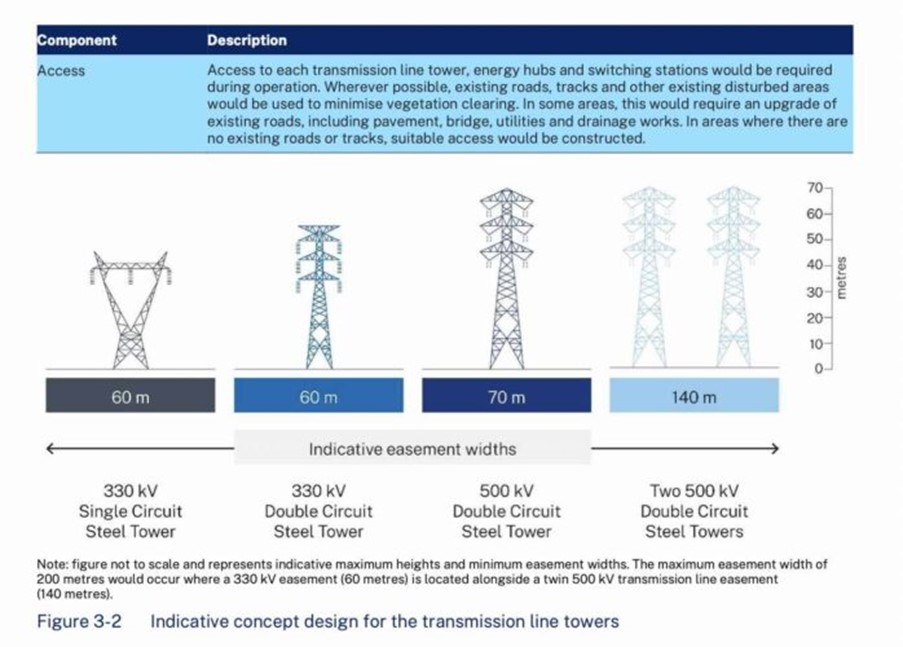

“EIS Lodged for Australia’s First Renewable Energy Zone – Greens Lament Compulsory Acquisition” Giles Parkinson, Renew Economy, 29th September 2023 writes ”The NSW government says the environmental impact statement for the country’s first official renewable energy zone has been lodged, in what it describes as a major milestone in the shift from coal to green energy.

The Central West Orana Renewable Energy Zone (REZ), based around and to the east of Dubbo, will deliver at least 3 gigawatts of new wind and solar generation, as well as storage, although this could be increased to 4.5GW. It is one of at least five such zones designed to deliver enough renewables and storage to replace the state’s ageing coal fired generators. The others are in New England, the south-west, the Hunter, and Illawarra.

The EIS has been lodged by EnergyCo, the state authority charged with managing the roll out of the REZs, and follows more than two years of work, and a change of route in response to early community feedback. It also canvasses a southern extension that has yet to get approval.

The EIS is essentially about the transmission needs for the zone, which includes new twin 500 kV power lines, double circuit 330 kV single lines, and a range of other infrastructure including switching stations. These are needed because the existing lines can’t support the increase in capacity.

“The lodgement of the Environmental Impact Statement demonstrates our commitment to ensuring NSW households, businesses and industry can access clean, affordable and reliable energy as coal-fired power stations retire,” energy minister Penny Sharpe said in a statement. It shows the NSW Government is getting the roadmap to renewables back on track, so we can ensure there is enough renewable energy to replace aging coal-fired power stations.

The proposed new transmission links will require easements up to 200 metres wide where a 330kV easement is located next to a 500kV easement. The towers will be up to 70 metres tall.

However, the NSW Greens issued a statement on Friday, saying it was “outrageous” that the government had begun compulsory acquisition processes for easements in the REZ, and complained about the “ridiculously” short turnaround for the 8,000-page EIS document.

“It is unconscionable for EnergyCo to notify landholders that their properties will be compulsorily acquired as soon as November when their project hasn’t even received planning approval,” said Greens MP Cate Faehrmann, who also heads a committee on the feasibility of under-grounding transmission lines.

“The Environmental Impact Statement (EIS) was only lodged yesterday, and the community will only have 28 days to make objections. “Not only is this a ridiculously short turnaround for an 8,000-page document, but to be sending out compulsory acquisition notices at this stage is indicative of just how farcical the consultation process has become for projects declared ‘state significant infrastructure’.

“EnergyCo progressing to compulsory acquisition despite not expecting a planning decision until mid-2024 makes a mockery of the state’s entire planning process. “If this is how all the REZs are going to be undertaken, the Government needs to do better to ensure these projects have the social licence needed to enable them to progress swiftly.”

The building of transmission lines has become a key issue – not just within the REZs in NSW, but also the long transmission links identified by the Australian Energy Market Operator to link states such as Tasmania, Victoria, NSW and Queensland, and to properly connect the Snowy 2.0 project to the grid.

The NSW government recently announced that it could dramatically increase the size of the Central West REZ to 4.5GW initially and then to 6GW by 2038. It has already conceded that the CWO REZ could cost $3.2 billion – five times more than originally thought – because of the increased capacity and be rolled out three years later.

The cost over-runs and delays are also having an impact on the decision-making process and negotiations over the timing of the closure of the state’s four remaining coal-fired generators – Eraring, Vales Point, Bayswater and Mt Piper. NSW has already flagged that it will talk to Eraring owner Origin Energy about the possibility of keep at least least some of its units open beyond the planned closure date of August, 2025.

However, this is likely to cost a tidy sum, and Origin is facing problems because the ash dams at the Eraring site are nearly full. Others have suggested that the delays in the transmission expansion could be at least partly solved by accelerating the roll-out of storage, and by using previously unrealised capacity on the state’s existing distributed networks, where multiple gigawatts of new wind and solar could be hosted.

The NSW government is hosting a number of different tenders for new wind, solar and long duration storage, and a special tender for two-hour “firming capacity” to help fill the gap that would be created by the closure of Eraring. Initial results from at least two of those tenders are expected soon.

“I’m calling on the Government and EnergyCo to immediately pause any works or compulsory acquisitions for the Central-West Orana transmission lines,” Faehrmann said in her statement. “I’m also urging the Independent Planning Commission to extend the consultation period of the project’s EIS exhibition.”

RenewEconomy sought additional comment from EnergyCo about the Greens’ claims but did not receive a response before publication

Disclaimer The comments and details in the articles in this newsletter do not reflect the views, policies or position of the Association or its member Councils and are sourced and reproduced from public media outlets by the Executive Officer to provide information for members that they may not already be exposed to in their Local Government areas.

Contacts Clr Kevin Duffy (Chair) cr.duffy@orange.nsw.gov.au or 0418652499 or Greg Lamont (Executive Officer) 0407937636, info@miningrelatedcouncils.asn.au. .

You must be logged in to post a comment.